Price Elasticity of Demand – An Important Indicator for Companies

Supply and demand are the most important reference points for pricing in a free market. A detailed analysis of these two parametres helps companies to properly assess the market situation and make key decisions, for example, on pricing or on launching a new product line. Price elasticity is a value that can transform these abstract parametres into easy-to-analyze figures. It indicates how flexible the market is when responding to changes in price for a product or service.

What Is Price Elasticity?

The price elasticity of demand refers to how sensitive demand for certain goods or services is in the event of price changes. Here, percentage values are ascertained and compared for both the price change and the change in demand.

A price increase normally leads to a decline in demand, as consumers no longer want or can afford to spend money on the product or service in question. Likewise, a price cut often results in greater demand. In these cases, we can observe price-elastic demand because the demand strongly depends on pricing and can fluctuate accordingly.

A different picture can be seen when prices increase for vital goods like basic food products, vital medicines or rented housing. Consumers can’t simply go without these products or switch to substitutes. As a result, demand remains stable even in the event of price increases – indicating price-inelastic demand.

These examples show that price elasticity primarily depends on whether and how many substitute goods are available. If a product or service can easily be replaced by another cheaper option, the price elasticity of demand is very high. However, if consumers depend on the consumer good, the price elasticity is accordingly low.

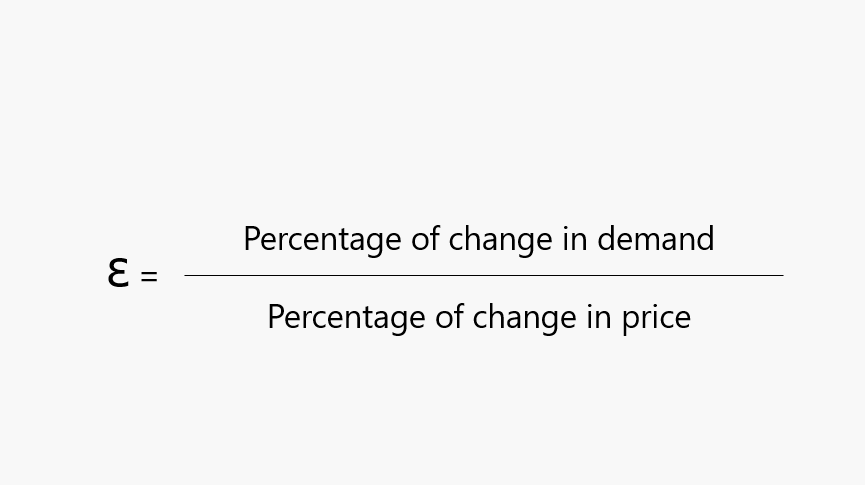

How to Calculate Price Elasticity

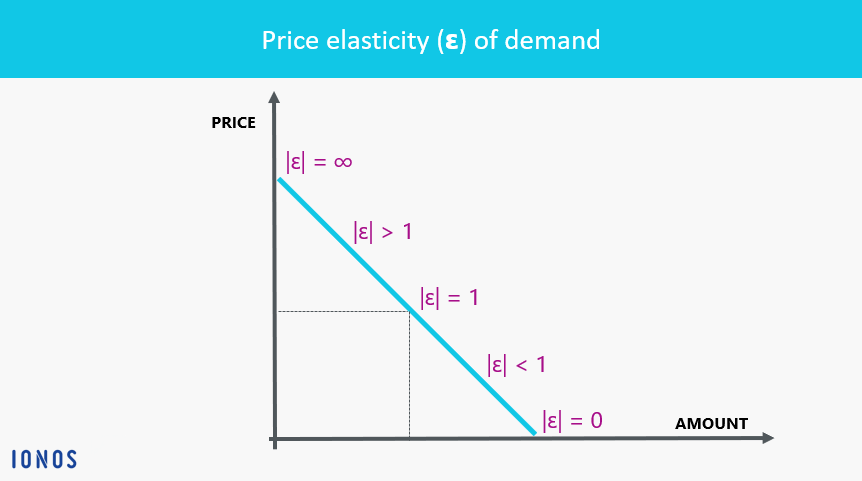

For price-elastic demand, the resulting value is larger than one, whereas the value is less than one for price-inelastic demand. If the value is exactly one, demand and price correlate with each other directly proportionately. In reality, this is very unlikely or only possible as a result of observing price elasticity over just a short period of time. The value zero is likewise exceedingly rare. This value would mean that price changes have no effect on demand whatsoever. A typical example for this completely price-inelastic demand are price increases for vital medicines, like insulin for diabetics.

The following graph shows how price and the quantity demanded correlate:

Example Calculation

A baker raises the price of his apple pie from £1.10 to £1.25 each. Before increasing the price, he sold 45 apple pies every day. Now he only sells 36.

Price increase from £1.10 to £1.25 = 13.6%

Decline in demand from 45 to 36 apple pies per day = 20%

Dividing the decline in demand by the price increase results in the value 1.47. Demand is therefore significantly price-elastic. For the baker, this means that he loses more revenue due to the lower sales than he gains with the higher price. Here, it therefore makes more sense to reduce rather than increase prices.

This example shows how a reduction in the sales price for products and services with a high price elasticity of demand can be used to increase the overall revenue of a company.

This consideration should also be kept in mind in relation to the minimum viable product. It is crucial for how much the costs for further developing a product should affect the sales price.

Watch this video for a greater understanding of price elasticity and how it is calculated:

Please note the legal disclaimer relating to this article .