Income Tax allowances: How to reduce your tax liability

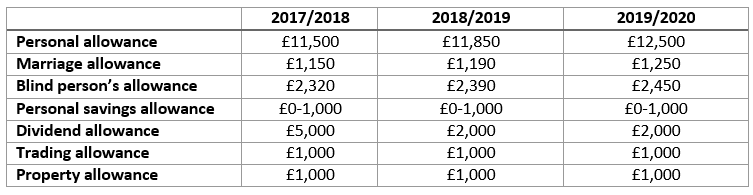

Tax allowances provide financial relief for taxpayers. Yearly tax allowances are interesting for employees because they reduce the amount of income tax an individual has to pay. Everyone who pays income tax - including entrepreneurs, the self-employed, retired people, and pensioners - benefits from tax allowances. How high they are in the end depends on what you qualify for, how much you earn, and whether you’re married, among other things.

What is a tax allowance?

The British welcome tax allowances with open arms since it means they get to keep more of their wages and have to surrender less to the government.

A tax allowance is the amount a person can earn without being subject to income tax.

Different types of tax allowances

There are many different kinds of tax allowances so it can get quite confusing. Make sure you don’t miss out on what you’re entitled to by making yourself more familiar with which allowances exist. Below is an introduction to each type.

Personal allowance

First of all, everyone has a personal tax allowance, which is the amount you can earn without paying any income tax. If you earn more than your personal allowance, then you pay tax on anything you earn above that amount. If the personal allowance amount is above the amount you earn, this means you won’t be making full use of your personal allowance and you will lose the unused part. It’s not possible to carry the allowance forwards or backwards to other years.

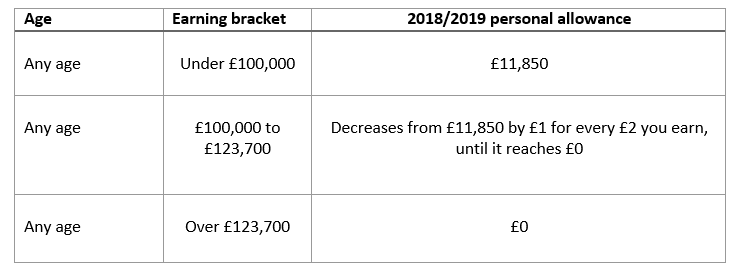

This is what the personal allowance for 2018/2019 looks like:

As the table shows, the personal allowance gives most individuals a tax-free allowance of £11,850 (for the tax year 2018/19), but is it less generous for individuals with a very high income. The personal allowance is reduced by £1 for every £2 that your adjusted net income is over £100,000, and you don’t have any personal allowance at all if your income happens to be over £123,700. Adjusted net income is based on your taxable income, but after deducting reliefs like pension contributions.

If either you or your spouse are registered blind, you can claim the blind person’s allowance. This gives you an extra £2,390 of tax-free income. It’s even possible to transfer the allowance over to your spouse if you don’t use all of it.

Marriage tax allowance

Whether you are married or in a civil partnership also plays a part in reducing your taxes. If you are, and you were born on or after 6th April 1935 then you could possibly qualify for the Marriage Allowance. This allowance enables couples to transfer a proportion up to £1,190 of their personal allowance between them if one earns more than the other. In doing so, they can reduce their tax by up to £238 in the tax year (6th April to 5th April the next year).

10% of this allowance is then subtracted from your annual income tax. If you were married before 5th December 2005, it is automatically worked out using the husband's salary. For couples married on or after 5th December 2005, it uses the highest earner's salary.

If one or both of you were born before 6th April 1935, you might save even more money (£336 and £869.50 a year) by applying for the Married Couple’s Allowance.

You cannot apply for the Marriage Allowance and Married Couple’s Allowance at the same time.

Savings interest

It’s possible to earn some interest from your savings without having to pay tax. The starting rate is the amount you can receive as interest before you start having to pay tax on it. However, the more you earn from other income (e.g. your wages or pension), the less your savings’ starting rate will be. If your other income amounts to £16,850 or more, you won’t qualify for the starting rate for savings. If you’re under this amount, the maximum starting rate will be £5,000. Every £1 of other income above your personal allowance reduces your starting rate for savings by £1. Here’s an example:

You earn £15,000 and get £200 interest on your savings. Your personal allowance is £11,850 so your remaining wages are £3,150 (£15,000 minus £11,850). These remaining wages reduce your starting rate for savings by £3,150. Your remaining starting rate for savings is therefore £1,850 (£5,000 minus £3,150).

Dividend allowance

Since April 2016, the Dividend Tax Credit has been replaced by a new tax-free Dividend Allowance. This allowance means that you won’t need to pay tax on the first £5,000 of your dividend income regardless of the non-dividend income you have. Anyone that has dividend income is eligible for this tax allowance. On any dividends you receive over £5,000, you will pay 7.5% on dividend income within the basic rate band, 32.5% within the higher rate band, and 38.1% within the additional rate band. Any dividends received on shares held in an Individual Savings Account (ISA) will continue to be tax-free.

Trading and property allowances

These are relatively new allowances of £1,000, which have been available since 6th April 2017.

Trading allowance

If you’re a sole trader and earn less than £1,000 per year, you don’t have to pay tax on your business income or register for Self Assessment with HMRC. If you earn more than a thousand pounds annually, you will have to register with HMRC, but you can use the trading allowance of £1,000 against your income to work out how much profit you’ve made.

Property allowance

Individuals with income from land or property are entitled to a tax exemption of up to £1,000 each year. If several people jointly own a property, then each person is eligible for this amount against their share of the gross rental income. If the property income is less than £1,000 per year, you don’t need to tell HMRC, but if it’s higher then you do need to declare the property.

Please note the legal disclaimer relating to this article.