Registering as self-employed

A self-employed person is someone who runs their business for themselves and takes responsibility for its success or failure. As soon as you become self-employed, you’re recommended to contact HMRC (Her Majesty’s Revenue and Customs) to let them know, but you actually have until the 5th of October in your business’ second tax year to register. For example, if you started trading on 1st February 2018, the latest date you could register is 5th October 2018. If you fail to do this, you could be hit with heavy fines.

The UK tax year runs from 6th April to 5th April of the following year.

You have to register as self-employed for tax and National Insurance purposes since these aren’t normally deducted from your income when you receive it. You must declare your income even if you don’t think you need to pay tax on it.

How to work out if you’re self-employed

It is possible to be both employed and self-employed at the same time. A person could work for an employer during the day and run their own business in the evening.

It is possible for HMRC to regard someone as self-employed for tax purposes even if employment law considers them to be a different status. It’s the employer’s responsibility to check if a worker is self-employed in:

- Tax law – whether they are exempt from PAYE

- Employment law – whether they have employee rights

It’s important to get this right otherwise employees AND their employers may have to pay penalties or lose benefit entitlements if this employee status is wrong.

If most of the following are true, then the employee is most likely self-employed and shouldn’t be paid through PAYE:

- They run their own businesses, are responsible for its success or failure

- They can decide which work to do and where to do it

- They can hire someone else to do work for them

- Their employee agrees on a fixed price for their work regardless of how long it takes to complete it

- They use their own money to buy business assets, cover running costs, and also buy tools and equipment for their work.

- They can work for more than one client.

If a worker changes their status to self-employed, they have a duty to inform HMRC. However, it’s not possible to register in advance: you can’t register for self-employment unless it’s fewer than 28 days until you start self-employment.

Who needs to register as self-employed

You will need to register for Self Assessment if any of the following apply to you:

- You earned more than £1,000 from self-employment between 6th April 2017 and 5th April 2018.

- You got more than £2,500 from renting out property.

- You have to prove that you’re self-employed e.g. to claim tax-free childcare.

- Your income from savings or investments was £10,000 or more before tax.

- You made profits from selling things like shares, a second home or other chargeable assets and need to pay Capital Gains Tax

- You want to make Class 2 National Insurance payments voluntarily so you can qualify for benefits.

For the full list please check GOV.UK.

If you don’t need to register, you can still make voluntary Class 2 National Insurance payments, which will mean you will get the full State Pension.

How to register as self-employed

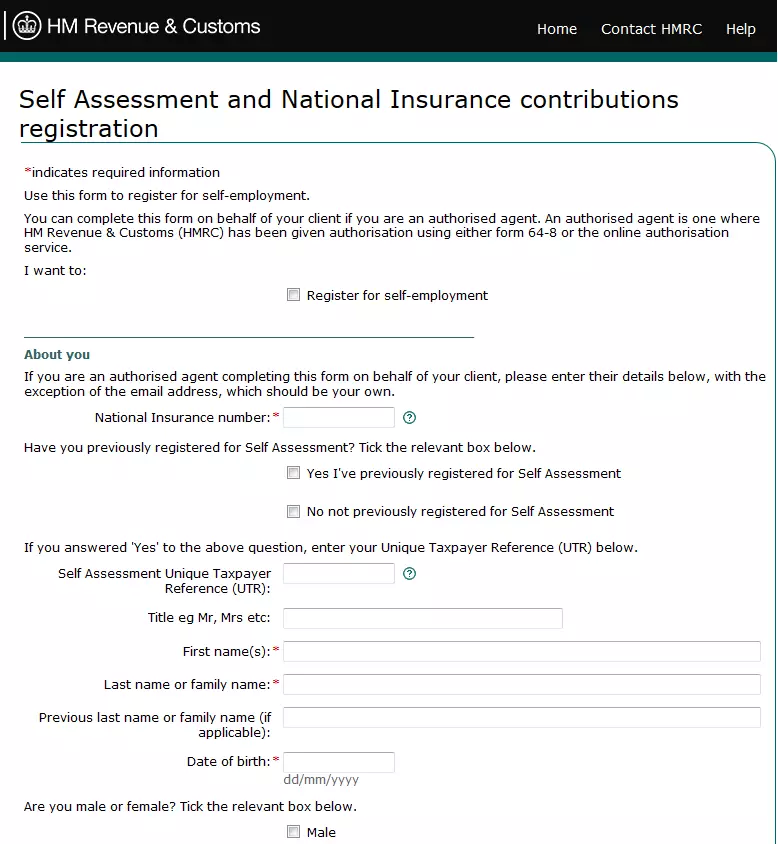

- You will first need to create a Government Gateway account by entering your full name, e-mail address, and the password you would like to use. You’ll then receive a user ID by post within 10 working days, which you use to log in to this page.

- Click on the section to register as self-employed for Self Assessment tax, then select whether you are a sole trader, partnership, or trust.

- Enter the date you started trading, which is when you started working for yourself and receiving money for it.

- This is the part where HMRC asks you for more information such as your National Insurance (NI) number, home address, contact details, and anything else regarding your new business. If you don’t have an NI number, you can apply for one by calling the Jobcentre Plus application line.

- Now you have to give information on the sort of self-employed work you do. You don’t have to go into detail: “plumber” or “architecture” will suffice. This is so that HMRC can ensure you’re taxed correctly and it also makes it easier to claim tax back.

- Make sure all your information is correct and submit the form. Once it has been received, HMRC will send you a letter with a 10-digit Unique Taxpayer Reference (UTR), which will be used on your tax payments.

It’s also possible to register as self-employed by post or by phone if you prefer.

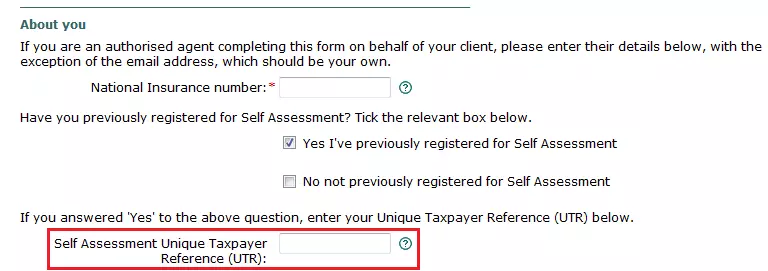

If you’ve sent a return before

If you’ve already registered, but haven’t needed to file a tax return for a few years, fill out the Self Assessment tax form (shown above) and make sure you have you 10-digit Unique Taxpayer Reference (UTR) to hand from when you registered previously.

Please note the legal disclaimer relating to this article.