General partnerships: freedom and risks for merchants

So, you want to start your own business? If you set up a trading business with at least one other person, the general partnership is a quick way to get started, since general partnerships do not need share capital like corporations do. The general partnership structure also offers some advantages when it comes to day-to-day business operations. In most cases, all partners are active in management and have full decision-making authority.

History of general partnerships

The history of the general partnership structure goes back to the end of the nineteenth century. The first piece of legislation proposed for the governing of business partnerships in the UK was the Partnership Act, first put forth in 1890. The Act has been revised several times, most recently in 2000.

What is a general partnership?

A general partnership is a partnership, i.e. an enterprise founded and operated by at least two legal and/or natural persons who are liable to the full extent of their assets.

A general partnership is a commercial business with at least two partners, who run the business together under a common business name (legally: company name). The general partnership structure means all partners are personally liable. Management are free to shape the business structure as they see fit.

Who are general partnerships suitable for?

General partnerships do not have strict preconditions for their formation. Unlike corporations, they do not require any share capital. However, partners do need to have some commercial skills to keep on top of their accounting obligations (or they can hire a tax consultant). Overall, the barriers to entry are comparatively low, and this also opens the way for less wealthy founders to become self-employed.

All partners in a general partnership can make business decisions on their own (provided the articles of association do not state otherwise). This naturally requires trust between the partners, but you should nevertheless plan and determine the distribution of tasks within the company in advance. According to current legal opinion, only shareholders may take over management of a company. Engaging an external managing director is not permitted within a general partnership structure.

General partnership profile

- Legal form: Partnership

- Legal basis: Partnership Act 1890

- Partners: At least two partners (natural or legal)

- Management: Freedom of individual action and obligation to be a self-governing body; in addition, management can be freely structured, e.g. with procuration

- Representation: By non-partners, authorised signatories in particular are possible

- Articles of association: No legal structural obligations; does not require written form (although highly recommended)

- Company (company name): Personal names, fictional names and subject names are all allowed.

- Location: UK, worldwide

- Accounting obligations: Inventory and balance sheet

- Share capital required: No

- Legal entity: Yes

- Legal capacity: Yes

- Liability: Partners are entirely liable with both business and private assets

- Tax liability: Flow through entity (shareholders are taxed through their income tax rather than business as a whole)

What do you need to set up a general partnership?

If you decide to found a general partnership, you just have to conclude an informal partnership agreement with your partners. This can be done orally or in writing. While there is no obligation for a written partnership agreement, it is nevertheless strongly recommended to draw one up, so that essential matters for later business operations are clearly laid out.

What belongs in the articles of association?

The articles of association should outline the purpose and aims of the general partnership, as well as the names of the partners involved. The official location of the company should also be included. By law, all partners have the same rights and duties. The articles of association should provide information on how the different partners will participate in the business, whether in kind, money, or work. This will help break down how the share of profits or losses should be measured.

Partners may, but are not obliged to, sit on the board of management. It is also possible to be represented by a proxy. Powers like decision making when it comes to taking out credit or the use of company assets requires regulation. Extraordinary contracts with high performance sums require a previous arrangement.

It may also be worth outlining the timeframe of the company in the articles of association, limiting business relations to a certain time, for example. If partners leave prematurely, severance payments should be already decided upon and be ready to implement. Even more importantly for the company is the question as to what form it will continue to take if a shareholder decides to leave the company. It may also be worth drawing up a no-competition clause in the contract for partners.

Non-compete clauses prohibit shareholders from establishing themselves and from participating in competing companies in the same trade if they already belong to a company. It is up to business partners to stipulate whether there will be a non-compete clause in the articles of association.

Some circumstances may require a formal drafting of the articles of association. This may be the case if, when a company is founded, there are certain processes initiated that require formal notation. For example, if a partner wants to provide a property as a contribution towards a business, it must be transferred to the company. Then the articles of association containing this point must also be available in writing and certified by a notary public.

Seed capital and reporting requirements

There is no minimum for seed capital if you are starting a general partnership. In practice, however, the business is unlikely to work if it has no assets. You will need sufficient funds to build up your business and to bridge the time until you make your first profits. All company property (material assets and capital contributions) ultimately belong to all the shareholders equally. This is called the total assets.

The founders of a general partnership need to select a name for their business and ensure that their business is registered with Her Majesty’s Revenue & Customs (HMRC) and Companies House, as well as any other relevant local authorities. Business owners have a great deal of freedom when it comes to naming their company. Both personal names (names of the shareholders) and subject names (referring to the type of business) are allowed, as well as entirely fictional names. Names must not include “Ltd or “LLP” or any other terminology that may mislead customers as to the legal nature of the company. Names must also not be deemed offensive and must not clash with an existing trademarked name. Registering with HMRC and Companies House are for taxation and formation reasons respectively; there is no legal obligation to register the name of the business.

Once you have registered with the relevant national bodies, you are free to begin doing business. It may also be worth your while to consider trade-marking the name of your company to ensure that there are no name disputes with other businesses in the future. It may also be useful to you to register with local Chambers of Commerce, or trade and industry groups in your locality.

Management structures

In a general partnership, all partners are automatically involved in company management, unless the articles of association designate specific individuals to the task. If this is the case, then all other partners are excluded from management.

When it comes to general partnerships, the principle of individual management applies. According to this principle, each member of management may act on their own authority in day-to-day business and represent the company externally. However, if another member of management objects, the transaction in question will not take place. You can also change this individual management in the articles of association – for example, in such a way that the managing directors always have to conclude contracts together.

Accounting, taxes, and profit distribution

Bookkeeping for a general partnership depends on the size of your business. If your general partnership is a small business with few partners, double entry bookkeeping is not required. Small general partnerships may follow the same basic accounting structures as a sole trader. On the other hand, if your general partnership is larger with numerous partners, you will be required to provide a balance sheet with your tax return which will necessitate double-entry bookkeeping. To provide clear and consistent records, you should also keep up-to-date inventories and accounts.

Since all partners are responsible for the general partnership, they are also jointly liable for taxes and other levies incurred by the company. However, it is important to note that general partnerships are not liable for income tax. Instead, they are known as “flow-through” entities, which means that the partnership’s income, losses, credit, and deductions fall to the partners themselves, who file and pay these taxes through their personal income tax return. Partnerships are not liable for corporation tax.

Thanks to the straightforward structure of a general partnership, it is assumed that all profits and liability will be split equally amongst the partners in the event of profit or loss. If partners wish to split the profits in a different ratio, this will need to be outlined in the articles of association.

Partner liability

A significant aspect of being in a general partnership is the partner’s liability towards company creditors. As previously mentioned, you are also liable with your private assets if you operate a general partnership. These are not only savings, but all attachable funds including real estate or valuables. This applies up to the legally stipulated seizure limit.

The contingent liability is characterised as unlimited, personal, and joint liability. This means that, if necessary, each individual partner is liable for the entire debt towards third parties – this cannot be restricted or excluded by the articles of association. However, in this instance, the partner can demand compensation from the other shareholders.

It makes it all the more important to take out liability and/or commercial insurance. There are liability risks towards co-partners and a general risk in the respective industry.

In the articles of association, however, partners may limit their internal liability to the amount of the shareholders respective contribution, for example. However, this does not affect liability towards third parties. Even if a partner forms a contract and then becomes insolvent, the remaining partners will be liable to pay.

Example: In a fictional general partnership, the articles of association state that partner Mr. Smith bears 40 percent of all liabilities, and partner Mr. Jones holds 60. However, if Mr. Smith creates a contract with a supplier for £10,000 and then becomes insolvent, Mr. Jones must pay the total debt of £10,000. The supplier is not affected by internal business agreements, instead he is entitled to the entire amount owed to him by the general partnership.

New partners bear all the liabilities that the general partnership has accumulated to date.

If the personal risks associated with a general partnership are too serious for you, you should consider choosing another legal form. A limited liability company or a corporation may be a better choice, as partnership liability can be limited with these structures.

Dissolving a general partnership

There are several instances where a general partnership may cease to function. Possible reasons include:

- The lifespan of the company is limited according to the articles of association

- The partners jointly decide to dissolve the general partnership

- A judicial decision determines the dissolution

- Insolvency proceedings are initiated without a continuation plan (partner dies or decides to leave with no articles of association in place to protect the business)

The end of a general partnership generally has three steps. A resolution to dissolve the company for any reason is only the first step. Before the company is completely dissolved, liquidation and company termination must still take place.

During liquidation, the general partnership processes its current business transactions, settles liabilities, and collects its own receivables. Once all assets have been distributed, the dispute ends. The last step, full termination, takes place once the business has been de-registered from all relevant agencies.

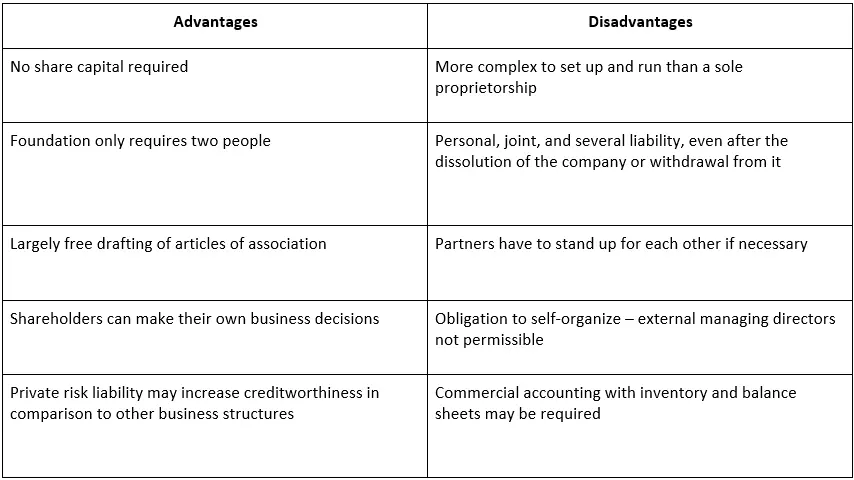

Advantages and disadvantages of a general partnership

A general partnership is an uncomplicated legal form that enables founders to quickly and inexpensively put a business idea into practice. The potential double-entry bookkeeping requirements may increase the administrative effort required, but will lend a reputation to the company in business transactions. However, this legal form also entails risks, especially for economically inexperienced persons. Before deciding to set up a general partnership, its advantages and disadvantages should be carefully weighed up.

Please note the legal disclaimer relating to this article.