Double-entry accounting simply explained

If you run a company, then you aren’t going to be able to avoid bookkeeping. Commercial accounting is an essential part of the accounting system and required is for all registered traders. After all, apart from the tax declaration, the revenue department still needs your annual balance sheet to determine the amount of type of your taxation. It’s also in your own interest as a business to keep your input and expenditure records in order to be able to determine your profits in the annual financial statements. You can only plan future projects over the next year, or several years, if you have an accurate overview of the numbers.

Double-entry accounting (also referred to as double-entry bookkeeping) makes it possible for you to keep your business processes manageable. But from when and for whom is double-entry accounting recommended? And how exactly do the individual invoice processes work? Double-entry accounting really isn’t as complicated as it looks at first glance. This guide will explain the basics of double-entry bookkeeping step by step, as well as point out exactly what you should pay attention to.

- Up to 50 GB Exchange email account

- Outlook Web App and collaboration tools

- Expert support & setup service

Definition: What is double-entry accounting?

Double-entry accounting refers to the system of commercial bookkeeping where all of a company’s business transactions are systematically listed. The annual account balance, or in other words, the consolidation of all business transactions within one fiscal year, has to be filed with the IRS HMRC at the end of the tax year. These annual report statements include a balance sheet as well as a profit and loss account (P&L). Using these, you can take your balance sheet at the end of the year and see how much revenue your company has earned you, taking into account all costs accrued and revenues generated.

Double-entry accounting, in the technical sense, is also understood twice: business transactions are booked to at least two accounts, that is to say, an account and a counter-account.

- Free website protection with SSL Wildcard included

- Free private registration for greater privacy

- Free 2 GB email account

Double-entry bookkeeping is particularly suited to large corporations that have to enter a huge range of costs and revenues. Simple accounting, on the other hand, records the revenue and expenditure of a company in a single comparison, or a so-called net revenue. There are no legal requirements detailing when a company must use either method in the U.K., though double-entry is recommended for larger businesses.

How does double-entry accounting work?

Anyone who deals with numbers can clearly see the benefit here. With double-entry accounting, two accounting methods must be present. The balance sheet is the basis for the profit and loss account (P&L). The British approach, also referred to as the traditional approach, classifies accounts into real, personal, and nominal. Assets and liabilities related to capital are nested under the real account, while personal accounts deal with those with whom the business has transactions, and nominal accounts include debit information on all expenses and losses as well as credit information on all incomes and gains. For the sake of clarity, it might be easier to use the American approach, which is primarily based on the rule that assets = liabilities + capital.

Make sure that you have your books in order and fully filled out in a timely manner. You need to enter all business transactions, aka all revenue and expenditures of your company. A small error along the way can make it so that your numbers don’t add up in the end.

Balance sheet

The balance sheet is the foundation of the double-entry system. This works with real accounts - that means that you record the current financial state of your company according to various plans, at both the beginning, and the end of each fiscal year. These can later be merged and compared with one another. This way, you can keep track of where, when, and what you spend your money on, as well as where your money comes from.

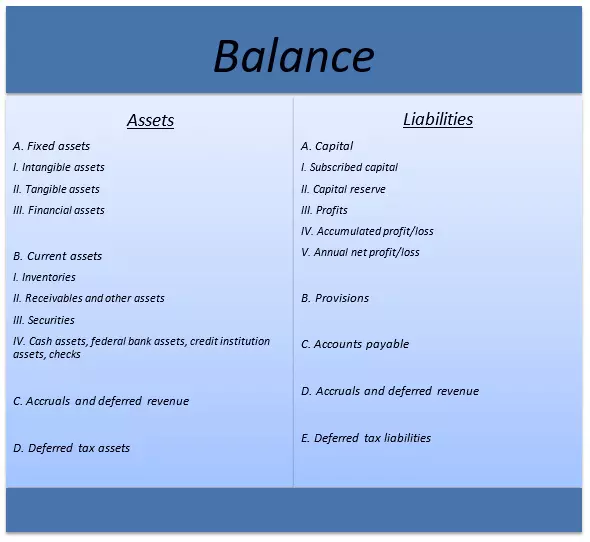

1. Basics: The division of assets and liabilities

The balance is divided into assets and liabilities. The assets describe all business transactions that comprise what you spend your money on, e.g., for fixed assets (technical equipment, machinery, etc.), inventories (raw materials and supplies), securities, etc. The liabilities, on the other hand, have to do with all transactions concerning the origin of your assets, i.e., where your money comes from - such as from capital, loans, profits, etc. The comparison helps you keep track of the areas in which your money is spent and gained.

A detailed overview of the individual asset utilisation and revenue can be found in the following graph (Table 1):

Balance sheets in the U.K. are only legally required to contain a limited amount of information, and can even be excluded entirely depending upon the type of business. Ultimately, the inclusion of a complete balance sheet is a good idea, as it helps accurately track finances and avoid errors.

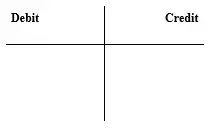

2. Fundamentals: The division of debit and credit

Once you have an overview of the individual areas, you can look at the individual inventory accounts. These are divided into a debit side (left) and a credit side (right). The ins and outs, or inflows and outflows of payments, are recorded in the corresponding areas.

Important note for the invoice: For inventory accounts on the assets side (see table 1), the payment inflows are posted in the debit and payment outflows are in the credit. On the liabilities side, it works the opposite way: Account balances are reduced in the debit and increased in the credit. This is the basic principle of double-entry bookkeeping.

There must always be a balance between the assets and liabilities: each transaction needs to be debited in one account and credited in the other. At the end of the day, it’s important that the total balance sheet has the same value on both sides. With this list, you can then determine the exact initial stock, final stock, and profit that your company had in a certain period.

The debit side is always on the left, and the credit side is always on the right.

3. Example of double-entry accounting: The balance sheet

Account balancing takes place within individual inventory accounts (or so-called T-accounts). The results are then transferred to the overall balance (ALM table). This provides you with a detailed list of all transactions as well as the total revenue and expenses of your company.

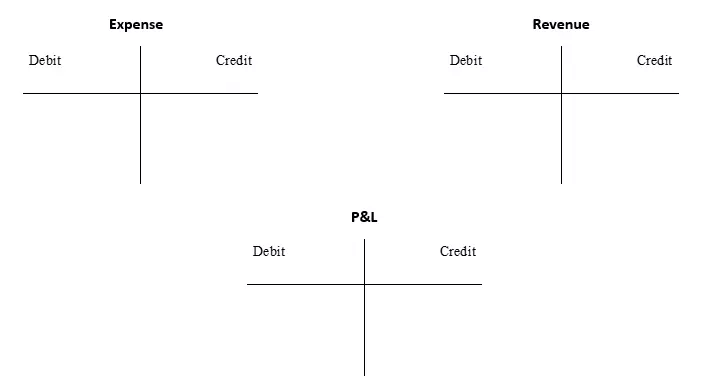

Now apply the basic principles from above. The calculation of individual inventory account is carried out within the T-accounts, which you build according to the following pattern:

Depending on whether the relevant account is on the asset side or the liability side of the balance sheet, you’ll apply the corresponding basic rules for the calculation.

- Inventory accounts on the assets side (e.g., Fixed Assets): Payment inflows are listed in the debit, outflows are listed in the credit.

- Inventory accounts on the liabilities side (e.g., Capital): Payment inflows are listed in the credit, outflows are listed in the debit.

- The balance sheet must have the same value on both sides.

The following video shows in detail how the calculation process looks, and how the results are then listed in the overall balance sheet:

Profit and loss report (P&L)

The profit and loss report (P&L) is part of the balance sheet that you can use to determine your company’s success over a certain time span. The revenue and expenses are compared here: if the revenue outweighs the expenses, you make a profit. But if the expenses are predominant, then you record a loss.

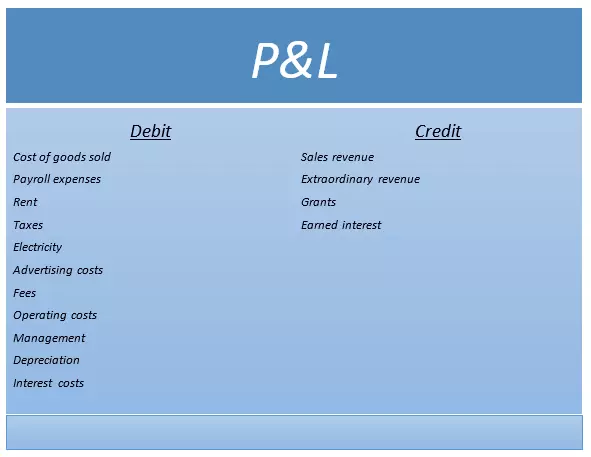

The calculation process works similarly to the balance sheet calculation. The only difference: the P&L doesn’t work with inventory accounts, but with expense and revenue accounts. These are divided between the debit side (left) and the credit side (right), respectively. Then the results of the individual accounts are transferred to the P&L report.

Example of a P&L report

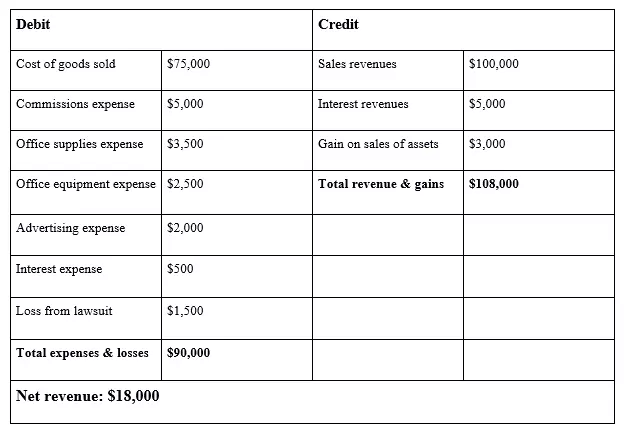

The following graphic (Table 2) shows how to group your P&L report according to the individual expense and revenue accounts:

The profit and loss report is based on the same pattern as the balance sheet. The results are entered in the individual expense and revenue accounts (T-accounts) in the P&L account. To make sure you don’t lose track, you should lose the following template:

Example of a P&L report:

In this example, you can see the total costs (debit) on the left, divided according to individual cost types, and the revenue (credit) on the right. The credit side denotes your assets (plus-value). Add all of the values together to get a sum of $108,000. The debit side shows your use of assets (minus-value). If you deduct the determined debit amount of $90,000 from the credit value it shows your profit of $18,000.

The P&L account is essentially the equity account, and so is on the liabilities side. With P&L accounts, make sure that you post the revenue in the credit and the expenses in the debit. At the end of the year, the values determined by the P&L account are transferred to the equity account.

Another visual example is given in this video:

There are, of course, a number of other ways for perfecting your accounting methods. To save yourself time so you’re not spending your entire day computing, there are special tools that will do it for you. Above all, large companies with correspondingly large revenue and expense amounts can use these tools to make their daily work easier.

Click here for important legal disclaimers.