Making Tax Digital (MTD)

Are you aware of the government’s flagship scheme Making Tax Digital? In a recent survey carried out by the British Chambers of Commerce, over 50% of business owners felt that they didn’t know much about the scheme and one-third of companies are still unaware of the new legislation. By law, most UK businesses are now required to keep and submit their tax records digitally. This change is intended to bring about significant and beneficial changes for the productivity of your business. So, if you have yet to make the changes or you have been delaying the update, now is the time to get into gear by following this guide to Making Tax Digital.

MTD for VAT

Making Tax Digital is a HMRC initiative designed to ensure an effective and efficient tax system for taxpayers in the UK. With the introduction of MTD for VAT, all VAT registered businesses are now part of the new scheme as of April 2019. The new digital tax system is intended to simplify the process of managing your taxes and is being introduced in stages.

MTD for Income Tax and Corporate Tax

When it comes to Income Tax and Corporate Tax, Making Tax Digital will not be in force until April 2020 at the earliest. This new digital system will phase out the old methods of tax submission by post and through the HMRC website. These fundamental changes to the way the tax system works will make the HMRC one of the most digitally progressive tax administrations in the world, envisioned to create a better environment for businesses within the UK. Subsequently, if you are one of the business owners who feel that they don’t know much about Making Tax Digital, follow this step-by-step guide from the HMRC, which breaks down all the finer details.

What does MTD mean for VAT registered businesses?

Firstly, it means more businesses will need to go digital and invest in digital skills, whether they want to or not. According to the government, digital record keeping for your business will ensure an efficient real-time record keeping process. Also, the vast majority of firms want to get their tax right, but this process can be difficult and sometimes costly. Therefore, MTD will aim to reduce tax mistakes and is expected to generate over £600 million in additional revenue in 2020-21.

So, for all VAT registered businesses with a turnover that exceeds the VAT threshold of £85,000, you will have to:

- Store and preserve VAT records digitally

- Send VAT returns to the HMRC via compatible digital software

The process of digital record-keeping can be a daunting procedure for businesses making that initial change. In a recent survey, over half of business owners and traders admitted that they are worried about how the changes will affect their business operations. Therefore, to ease the stress slightly, this VAT Notice from the HMRC provides all the details concerning the records that your business must keep digitally.

The HMRC expect most customers will be able to meet the legal obligations of MTD. There has been an exemption threshold set at £10,000, but you can still opt in if you wish to. There are other groups that are exempt from upgrading to the new digital scheme due various factors such as age, disability or geographic remoteness. For more information or to apply for an exemption, contact the HMRC’s VAT: general enquiries.

What dates do I need to keep in mind?

The main date to keep in mind for VAT registered businesses was April 2019. However, the HMRC has announced that certain businesses have a deferred Making Tax Digital for VAT start date. If you are one of the following businesses, your start date will be October 2019.

- Trusts

- ‘Not for Profit’ Organisations that are not set up as companies

- VAT divisions and VAT groups

- Local authorities

- Overseas traders

For more information regarding your business status, consult this Sage article on MTD for VAT.

The deadline for submitting your business’ VAT will not alter, the only change to the process is to complete it digitally using Making Tax Digital-compatible software. Listed below are example dates assuming quarterly filing:

- 31.03.2019 end date: Your first VAT quarter under Making Tax Digital for VAT started on 01.04.2019.

- 30.04.2019 end date: Your first VAT quarter under Making Tax Digital for VAT started on 01.05.2019.

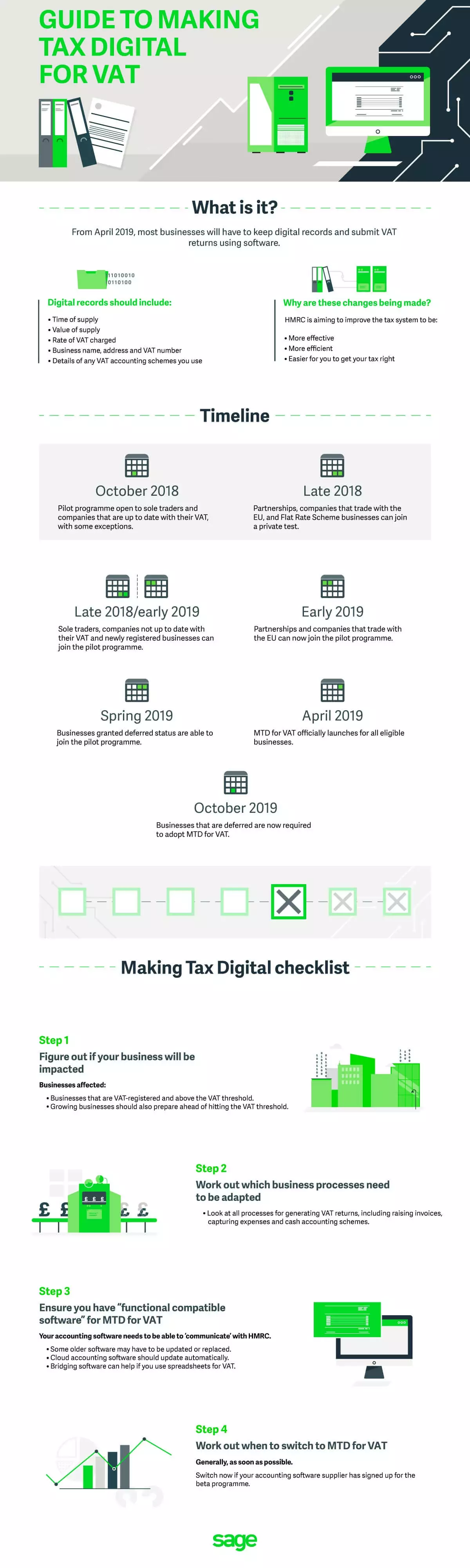

Take a look at this “Guide to Making Tax Digital” infographic, for a brief overview of all the useful information and dates your business needs to consider:

What software do I need?

Now that we’ve covered the background and legislation, let’s consider why you need MTD-compatible software in order to take your business a step forward into the digital future. Although the HMRC do not offer their own software, they created a list of software companies whose products are MTD-compatible. The list is HMRC-approved and all of the products listed revealed a working prototype or released version of their digitally linked software. A digital link is one of the key terms in helping you understand the new system. Essentially, a digital link is a link which is both digital and automated, allowing data to be moved between different software or computer systems.

In order to avoid being left behind, capitalise on this new and revolutionary digitalised tax system to make all of your business tax operations more efficient in the future. To help you enhance your knowledge of the new legislation and potential obstacles that business may face when trying to adapt to this new system, check out this detailed article on “How to Make Tax Digital for VAT”.