Small business invoice

There were as many as 5.6 million small businesses in the UK at the start of 2018. As a small business owner, you will be aware that you have to invoice your clients in order to receive your money and maintain an organiszed cash flow to keep everything running smoothly. Creating a professional-looking small business invoice isn’t difficult, but we’ve compiled a list of what to include to help you out.

According to the UK’s Companies Act 2006, a small business is defined as one that:

- doesn’t have a turnover of more than £10.2 million (previously £6.5 million)

- doesn’t have a balance sheet total of more than £5.1 million (previously £3.26 million)

- doesn’t have more than 50 employees.

What needs to be included in a small business invoice

There’s no right or wrong way to create a small business invoice, but it is essential that it includes all the important information between you and your clients:

- A unique identification number

- Your company name, address, and contact information

- The customer’s name/company’s name you’re invoicing

- A description of the goods/services

- The date the goods/services were provided

- The date of the invoice

- The amount of the goods/services

- The VAT amount, if applicable

- The total amount the customer/company must pay

If you’re a sole trader, you also have to include your name and any business name that you use. An address is also compulsory so that any legal documents can be delivered to you. If you’re creating an invoice for a limited company, you have to include the full company name just like it appears of the certificate of incorporation. If you want to include the names of your directors on your invoices, you have to include ALL their names.

1&1 IONOS can help you take care of your small business invoices. Make sure you don’t miss any important sections out by using the online accounting software.

How to send an invoice

You can send your invoice by mail, but nowadays e-mail is the more common way since the small business invoice will arrive much faster and there’s less chance of it getting lost along the way. There are also some extra steps you can take to make sure the whole process goes as smoothly as possible. You could call the client after you’ve sent the invoice to make sure they understand it and don’t have any questions about its content. Since you can never be too sure about security online, it makes sense to send the invoice in an un-editable format, e.g. PDF, so criminals can’t intercept it and change the bank details to their own in order to receive the money.

How long to keep an invoice

All small business owners are recommended to keep any invoices they create in case they are audited and need to prove the validity of profit. You can be fined £3,000 by HMRC or disqualified as a company director if you don’t keep accounting records.

You might even have to keep them up to 6 years if:

- they show a transaction that covers more than one of the company’s accounting periods

- the company has bought something that is expected to last more than 6 years e.g. machinery

- you sent your tax return late

- HMRC has started a compliance check into your company tax return.

Even if these don’t apply to you, it’s still better to keep your invoices in a safe place so that if a dispute arises between the company and a client, it’s also good to have all the invoices saved so they can be quickly accessed and the matter solved. By keeping your invoices as organised as possible, you can better balance your budgets as well as manage your business’ accounts payable and accounts receivable functions.

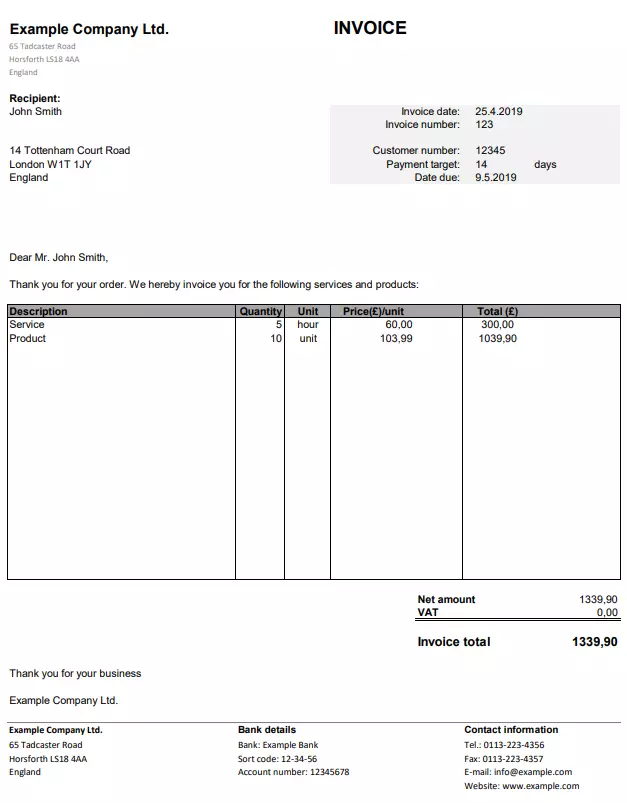

Small business invoice template

The following example shows an invoice from the fictitious small business, Example Company LLC. You can download the template and customise it for your own invoicing.

Please note the legal disclaimer relating to this article.