Ansoff Matrix – what actually is it?

What does the future look like for your company? "Growing" is certainly not a bad answer, but not all growth is the same. That's what Igor Ansoff thought in 1957 and developed the concept named after him. The Ansoff Matrix gives managing directors and managers the opportunity to better determine the type of growth. This relatively simple tool can be used to keep an eye on a company's growth strategy.

The Ansoff Matrix and its terms

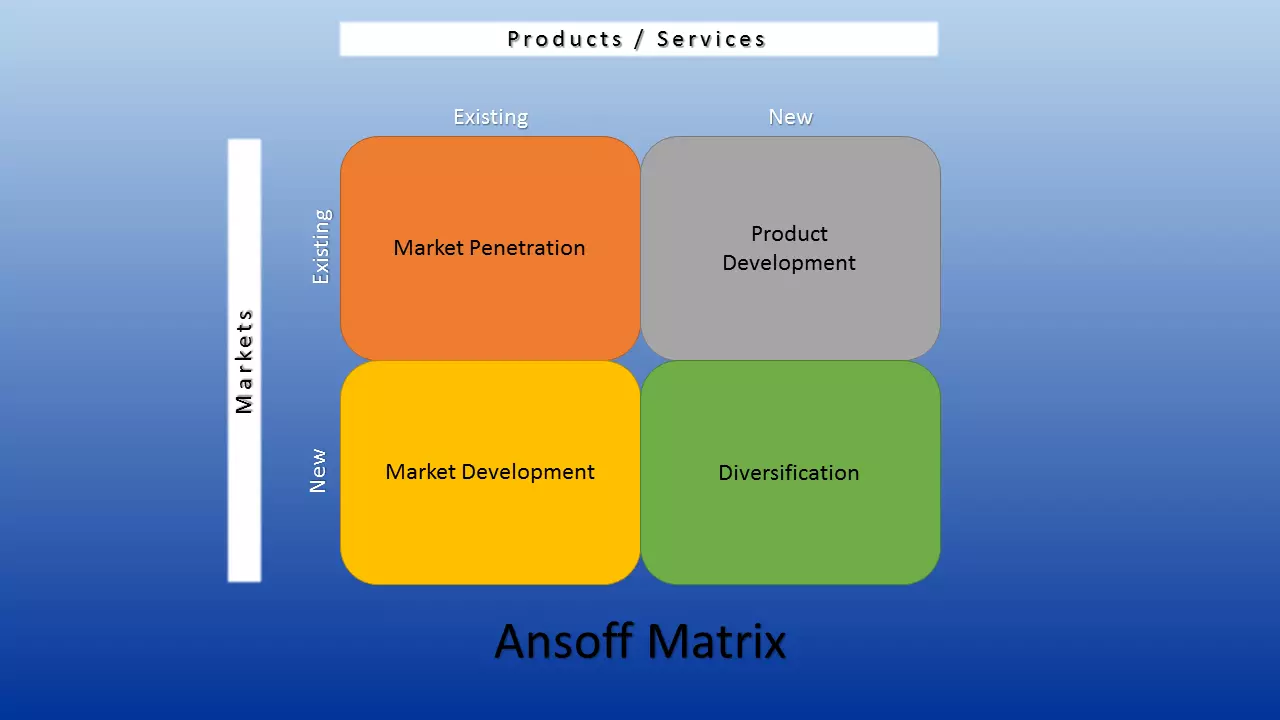

The Ansoff Matrix is basically a table. Four different categories allow for four combinations. The columns refer to the products or services of your company and can be categorised as “existing” and “new.” The rows reflect the markets. Here, too, the matrix distinguishes between markets in which your company is already active and those, which you can enter anew.

Based on which innovations – if any – come into question for you, different strategies can be defined.

The Ansoff Matrix is a table that shows different growth strategies for companies. The combination of the two factors “product” and “market” and the states “new” and “current” results in four different Ansoff strategies.

Market penetration

So, you don't want to add new products or services to your portfolio nor do you want to tackle new markets? Then market penetration is the right strategy for your company's growth. Growth is achieved by taking more customers away from the competition in the existing market. Another part of this strategy is to increase sales through your existing customer base, i.e. to motivate your customers to purchase more frequently. For both factors, it is necessary to implement new marketing strategies. Using an adjusted pricing policy also achieves good results. Sales training is also recommended, especially to increase sales through existing customers.

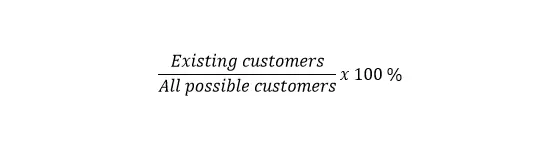

Even if you can win over additional new customers, the growth is limited by market penetration, since the number of customers within a market is limited. In order to determine the growth potential of your company with this strategy, you should first know your degree of market penetration. You get this by dividing your existing customers by the number of potential customers in the market:

Market development

Market development is different: This Ansoff strategy is the one to use if you want to continue with your existing product portfolio but want to take on new markets. This means, for example, expanding to another geographical region or increasing the target group. In order to achieve effective growth with market development, a high marketing effort is required – even more than with market penetration. Due to the high financial investment, this strategy involves a certain risk.

Product development

If you establish yourself with a new product in an existing market, the growth strategy "product development" is applied. You have two different options: Either you develop a completely new product for your target group or you produce a variant of a product that you are already selling.

If you respond to customer feedback, you can better adapt the new or modified product to the target group. The costs for this strategy are comparatively high because the development of new products or services is expensive. There is a risk here too: you will only know if the innovation has been successful after its release on the market.

Diversification

It’s also possible to take on a completely new market with a new product. This strategy involves the highest risk, but can also have the greatest success. In addition to increased sales, this strategy also enables you to develop new customer groups for your company. Diversification also helps to spread the risk: instead of focusing on a single product or on a specific market, this growth strategy gives you several driving forces for your success. This fourth strategy of the Ansoff Matrix can in turn be divided into three types. The choice of the right strategy depends on your willingness to take risks.

Horizontal diversification

With this type of diversification, you expand your portfolio with an article that is similar to an existing product. This has the advantage that your company already has expertise in this area and that you can make the most of existing processes. The new products speak to new customer groups as well as those who’ve bought from you in the past. Compared to other diversification measures, horizontal diversification is quite low risk: You are in a field that you are already familiar with – this helps you to avoid making the wrong decisions.

Vertical diversification

Vertical diversification is less about expanding the product range than about expanding the value chain. For example, you can take over the distribution of your goods yourself (forward integration) or take further steps in the manufacturing process into your own hands (backward integration). This makes you less dependent on suppliers or dealers. The additional services can also be resold to other customers. In order to set up new production facilities or shops, you have to invest a lot, which leads to an increased risk.

Lateral diversification

You take the greatest risk with lateral diversification: instead of concentrating on your existing business and expanding it, you go in a completely new direction. With a completely different product, which is disproportionate to the products already on offer, you are placing yourself in a new market. With this growth strategy, you are turning to a completely new industry in which you do not yet have any expertise. This approach is associated with high costs and it is difficult for entrepreneurs to work out whether the venture will be successful or not. This is why lateral diversification is only recommended if your company can pick itself up again after failure.

This is how the Ansoff Matrix works: example of business growth

In our example, we assume that there is a fictitious bakery, Tanya’s Treats, that wants to grow. We’ll go through one Ansoff strategy after another and show what steps the company has to take to grow. So far, the bakery has a location, but since it’s still a small company, Tanya’s Treats initially wants to take little risk and decides to penetrate the market first. For this reason, the managing director asks the sales staff on the sales floor to always point out other goods to customers. In addition, she wants to introduce regular discount actions, which will turn passers-by into regular customers. Neither the market nor the product range has expanded, but with clever marketing strategies the company can increase its sales.

To be able to grow further, the managing director now takes a further step and opens an additional shop in the neighbouring town. The same goods are sold there. The market development risk is somewhat higher because the company cannot foresee whether the offer will be just as well received in the new market. Once the new market is secured, the company can think about product development. In addition to the frosted cupcakes already on offer, the company is now also selling rainbow cookies. Since the entire existing infrastructure is still being used, the managing director can keep the risk low. She can generate more turnover with a new or adapted product while maintaining a constant market.

In the end, Tanya’s Treats has grown, conquered new markets, and expanded its product range. Now we have enough reserves to be able to take on even greater growth risks. For this reason, the managing director opts for diversification as a strategy – and initially for horizontal diversification, i.e. for expanding the range. She also decides to include pastel macarons in the range. Tanya’s Treats therefore introduces a new product to a new market, the market for coeliacs.

The next step for Tanya’s Treats is vertical diversification. The managing director wants to pursue both forward and backward integration. Therefore, she decides to start her own farm with dairy cows and chickens for eggs in order to organically source her ingredients. In addition, Tanya’s Treats also opens up its own café. This makes the business less dependent on the supplier and it also takes over a new distribution channel for its own products.

Now it's time for lateral diversification: Tanya’s Treats’ managing director decides to manufacture and sell watches as well in the future. The new product has no relation to the actual portfolio and also appeals to a new market. Although the managing director is taking a big risk, this is the only way to guarantee steady growth in the long term.

Criticism of the Ansoff strategy

Although the Ansoff Matrix is one of the cornerstones of growth planning, you have to be aware that it is firstly quite old and secondly quite simple. The model was developed in the 1950s and therefore also reflects the corporate strategy thinking back then. The Ansoff Matrix is based on only two factors: products and markets. The concept can be further split into groups: products are divided into existing, modified, and new ones, and the “market” factor is divided into the geographical market and the target group. However, this more modern adaptation also leaves many factors out of the equation. For example, the product-market matrix completely ignores the competition.

Other matrices can also help entrepreneurs. Some entrepreneurs choose BCG-Matrix or the McKinsey portfolio.

Please note the legal disclaimer relating to this article.