The A/R invoice

If companies want to claim money from their customers for delivered goods or services, they write invoices. In order to be binding in the general sense, and valid in the case of taxation, invoices must meet certain requirements. One of the most important invoice types for any company is the accounts receivable (A/R) invoice. But what is the definition of an outgoing invoice? What information should be included in the document, and what else does the issuer of an A/R invoice have to keep in mind?

A/R invoice: A company’s outgoing invoice is the invoice that they send to customers. They are used to list amounts of money for goods delivered or services rendered and to have them paid by the customer. Outgoing invoices therefore enable revenue to be generated and are part of accounting.

What is an outgoing invoice?

An invoice is referred to as an A/R invoice from the perspective of an invoicing party and as an A/P invoice from the perspective of the invoice recipient. The basis for such an invoice is usually a contract concluded between two trading partners in which the delivery and remuneration to be paid for were agreed. The invoice has a different function for each of the two contracting parties:

- It is used by the issuing company to request payment from the customer for goods and/or services that have been delivered. It is therefore a written request for payment.

- It enables the customer to check the services, for example, whether quantities of goods or working hours are listed correctly.

Outgoing invoices must, by definition, be made out in writing. They should therefore be printed out and mailed or sent digitally by e-mail. An oral invoice is not legally binding.

What function do A/R invoices have in accounting?

A/R invoices have an important function in accounting. They are used to create receivables from customers that appear on the assets side of the balance sheet. If the invoices are then paid (you can also record this as revenue when the service has been provided and billed, but not yet paid) the amounts appear as revenues in the profit and loss account – accounted for in double entry bookkeeping. If a customer is in arrears with their payment, outgoing invoices also serve as a basis for reminders.

The A/R invoice: Important for VAT

The outgoing invoice is also of central importance for VAT. On the one hand, it is used to determine the amount of VAT that the issuing company may owe the tax office for the relevant delivery or service. For this purpose, it must also show the tax in the invoice. When it must actually pay this tax depends on various factors (advance VAT returns, target or actual taxation, as well as special cases). On the other hand, the invoice may serve the recipient as a basis for claiming the VAT paid to the supplier as input tax from the tax office and recovering it.

What information should an A/R invoice contain?

For an A/R invoice to be legally binding, companies must provide certain information in the document. The following information is required:

- Name and address of the invoicing party (including the type of company, if applicable)

- Name and address of the invoice recipient

- Tax number or sales identification number

- Invoice date

- Consecutive invoice number

- Time of delivery or period of service provision

- The quantity and description of the goods or services supplied (individually and broken down by quantity or volume)

- Net invoice amounts, broken down by VAT rate

- VAT rate

- Gross invoice amount

- Indications of previously agreed discounts, bonuses or rebates (if offered)

For smaller invoices, less data is required. The mandatory data for these so-called small amount invoices include:

- Name and address of the invoicing party

- Invoice date

- The description of the goods and services supplied (individually and broken down by quantity or volume)

- Gross invoice amount

- VAT rate

Companies registered in a professional register or association may be required to provide additional information, depending on their legal form:

- Legal form

- Registration number

- Personally liable partners

- Managing director

Additional information is also practical for commercial transactions and should be included in the A/R invoice. This information includes:

- Customer number

- Order number

- Term of payment

- Phone number

- Fax number

- E-mail address

- Website

- Biller’s bank details

- Identifier to be used when making payment

The latter information is common, particularly for companies that send invoices and receive payments in large numbers. It helps them to record incoming payments correctly.

Of course, it is not forbidden to specify further information on invoices for smaller amounts. They ensure clarity, make it easier for both sides to assign the invoice and serve as a service for the customer.

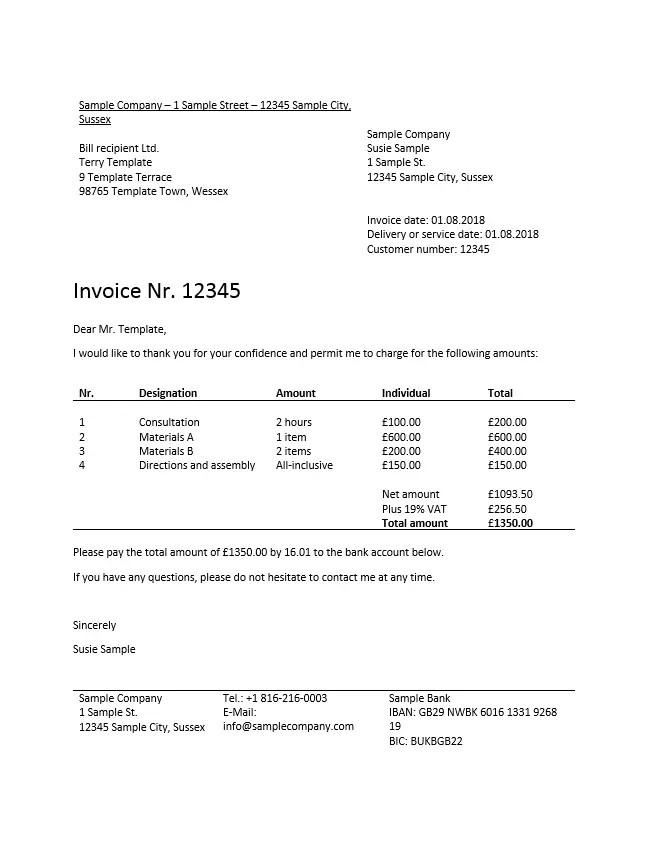

What does an A/R invoice look like?

An A/R invoice does not require a special form. As long as the document contains all relevant information clearly and legibly, companies are free to design their invoices. Visually, it can therefore deviate from the following example. Outgoing invoices can easily be designed by you individually with the help of common office programs – you can also find plenty of readymade invoice templates available to download. A signature is not required for the document to be legally binding.

An A/R invoice is not just a payment request to the customer, but also a means of communication. Therefore, use the invoice to thank the customer for placing an order, to point out an action to the customer, or to ask for a recommendation if they were satisfied with the service provided.

Difference between A/R invoice and budget billing invoice

Particularly in the case of larger projects or longer-term service provision, issuing several partial invoices instead of a single outgoing invoice offers a number of advantages – both for the exhibitor and for the recipient of the invoice.

The partial invoice refers only to a part of a good or service, in contrast to an A/R invoice, in which goods and/or services provided are recorded in their entirety. In practice, the partial invoice is used, for example, for electricity and gas deliveries, construction projects, or factory construction.

- The service provider has the option of pre-financing the project on an ongoing basis, by means of partial invoices and at the same time, which reduces the risk of payment defaults.

- The customer benefits from a financial burden that can be planned over the period of service provision and can check the completion of the project in phases.

The information required for interim invoices is the same as that required for outgoing invoices. In addition, however, a partial invoice must be marked as such, and, if necessary, have a sequential invoice number.

Please note the legal disclaimer relating to this article.