How to correctly calculate, report, and reverse accruals on the balance sheet

As an entrepreneur, you are obligated to file your taxes with the HM Revenue & Customs. This can be made a lot easier by using the double-entry bookkeeping system and by keeping your records as detailed as possible. A complete balance sheet involves correctly reporting accruals and reversing them if required. But what exactly are accruals in accounting and how are they calculated, recorded on the balance sheet and reversed? We will explain the steps you need to take for accurate booking entries.

Not everyone has to keep accounts and file taxes. Check on GOV.UK’s website to see if you’re exempt from paying taxes.

What are accruals?

Accruals are expenses or revenues incurred in a period for which no invoice was sent or no money changed hands. If, for example, you’re in an ongoing court case, you can assume that legal fees will need to be paid in the near future and not straightaway so you have to factor that into your calculations and it could even be that the process continues until the next calendar year. Since accruals are amounts that your business still owes at the end of the accounting period, you simply estimate the accruals and the figure should then correspond to the future legal costs. As soon as the legal fees have been paid, you can reverse the accrual on the balance sheet. Provisions are similar to accruals and are allocated towards probable, but not certain, future obligations. An accrual is where there is more certainty that an expense will be incurred.

Accrual accounting differs from cash accounting in that revenue and expenses are recorded when the service is performed or when the expense is incurred regardless of when the cash is received or paid. This video explains the difference between the two in more details:

To display this video, third-party cookies are required. You can access and change your cookie settings here.

To display this video, third-party cookies are required. You can access and change your cookie settings here. Here is an example of how accrual accounting works:

Company X has insured one of its buildings and gets invoiced for this service twice a year (£500 each time). Using the cash accounting method, Company X would record £500 twice a year, but the accrual accounting method would mean that the company would divide the whole amount for the year (£1000) between twelve months, which would mean paying around £83 per month.

Why are accruals used?

There are two reasons why accruals are used:

- If the company has already taken benefits, but hasn’t yet paid

- If services have been provided, but the company has not yet been paid

By using accruals, it enables a business to see beyond simple cash flow and to plan better. It’s normal for a company to record transactions where cash changes hands, but transactions aren’t always like this. For example, an airline will receive payment weeks or months in advance as most people book their flights quite a while before. This means that the airline has received payment, but the service still needs to be delivered. An example that shows the opposite is an appliance store that lets customers buy on credit so they receive their washing machine, but might not have to pay for the first year, which means the company knows it can expect money after the first year’s up.

When a company records an amount as an accrual, it helps them to have a better overview of their financial situation so they know what they still owe or what is owed to them.

Types of accruals?

Although there are many kinds of accruals, most of them fall into one of the two categories:

- Expense: when a company has received services and goods, but it hasn’t made a payment yet. An example is a company receiving an electricity bill in March for the last few months’ electricity usage. The business would record this as an expense accrual.

- Revenue: when a company has provided goods or services, but payment hasn’t yet been received. For example, when a customer buys a vehicle on credit and pays later. The company knows it has this money coming in at a certain point.

How to report accruals

There are two ways that you can choose to record your business income and expenses:

- On a cash basis: this is where money is recorded at the time that it actually comes in and goes out of your business.

- Using traditional accounting (accruals basis): this is where income and expenses are recorded when you invoice customers or receive a bill.

However, HM Revenue & Customs only accepts the accrual accounting method since the cash basis method doesn’t give an accurate measure of profit or loss for the accounting period. Therefore, it’s recommended to stick with this method. If you happen to run a small business, you can make use of a special concession, which allows you to use a form of cash-based accounting for VAT purposes. In a nutshell, you can complete your VAT return on a cash-based accounting method, which is referred to by HM Revenue & Customs as 'cash accounting'. As your business grows, you might find it necessary to switch to accrual accounting so that you can track revenues and expenses more accurately.

An accrued expense is usually only for a limited period of time (i.e. will probably get settled in the next few months), so you therefore class this liability as a current liability. It should then appear in the current liabilities section of the balance sheet:

How to calculate accruals

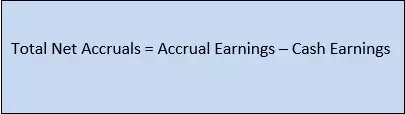

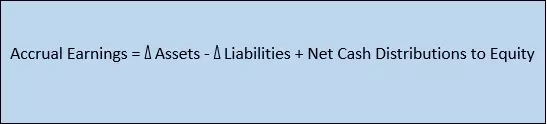

Using the balance sheet method, you can calculate accruals with this equation:

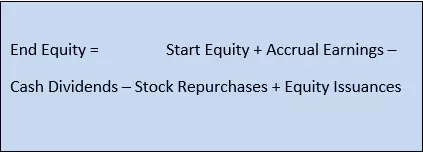

Since the balance sheet doesn’t directly reveal the accrual earnings, there are further calculations to be made.

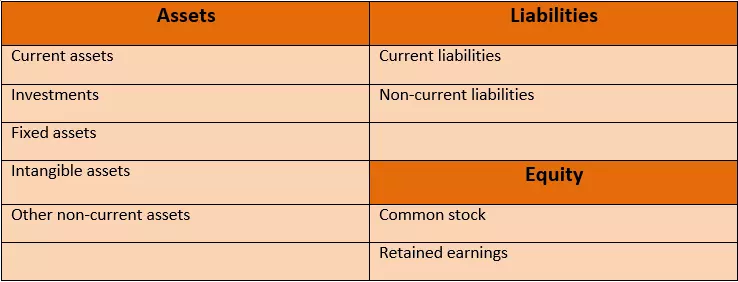

In order to calculate accrual earnings, you need to know to what the retained earnings are, which can be found in the owner’s equity section of the balance sheet.

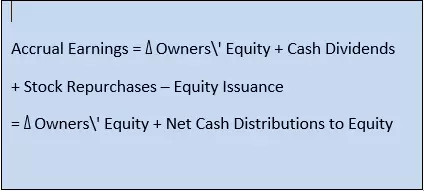

To calculate accrual earnings, the above equation can be rearranged in order to work out the difference between ending owners’ equity and beginning owners’ equity. This is all dependent on the dividends, stock issuances, and stock repurchases.

It can be assumed that assets – liabilities = owners’ equity, so this next equation can be used to find out the accrual earnings:

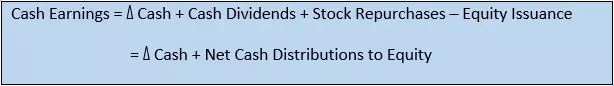

To calculate cash earnings, you must look at the change in the cash account. This cash account is affected by net cash distributions to equity holders, therefore, adjustments need to be made for these items. Cash earnings at the end of the year or period will look like this:

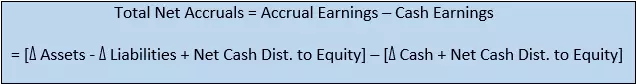

The section started with the basic total net accruals equation and then went on to define accrual earnings and cash earnings. The total net accruals can be substituted into this equation now that these definitions are known:

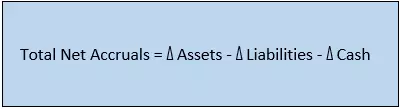

This then means that the net cash distributions to equity cancel each other out, which reduces the equation to:

Although we’ve gone into detail with the Balance Sheet method, there is also another method you can use to calculate accruals. This is the Statement of Cash Flow method, which will also leave you with the same accrual amount at the end of your calculations.

How to reverse accruals

When you reverse accruals, you’re cancelling the prior month’s accruals. Accrual accounting matches revenue and expenses to the current accounting period so that everything is even. Accruals will continue to build up until a corresponding entry is made, which then balances out the amount. By reversing accruals, it means that if there is an accrual error, you don’t have to make adjusting entries because the original entry is cancelled when the next accounting period starts. Despite this, reversing accruals are optional or can be used at any time since they don’t make a difference to the financial statement. They can be used to match revenues, expenses, and prepaid items to the current accounting period, but cannot be made for reversing depreciation or debt. Reversing accruals can either be made automatically or manually. Manually would mean that entries are made on the first day of the month whereas a system would automatically reverse the entry on the first day of the next accounting period. Reversing accruals are very advantageous for large companies since they lessen the risk of double booking entries and save time because prior accrual history doesn’t need to be researched. It’s easy to keep an overview and complete the task without accounting knowledge since all it entails is cancelling previous entries. Click here for important legal disclaimers.