How to keep a mileage log: Doing it right

A customer appointment in another city, the financing discussion at the bank, or the trip to the airport before the business trip – many self-employed people and regular employees use a company car for this. As a rule, however, it is not only used for business trips, but also for private purposes. The law sees this as a monetary advantage for which taxes are payable, just as they are for a monetary income. This applies to business owners and self-employed people, as well as employees that are afforded a company car.

Who needs to keep a mileage log and why?

The tax office generally assumes that a company car is also used privately to a certain extent, even if the driver has their own vehicle. There are exceptions only in special cases – for example, if the vehicle is a workshop car or if it can be proven that the vehicle is really only used for business purposes. How the private use of the car is taxed depends on the relationship between private and business use. This, in turn, determines the commercial status of this vehicle. Here, the law distinguishes three possibilities:

- The vehicle is predominantly used for business purposes, i.e. more than 50 percent of the time. Then it is definitely part of the “necessary business assets” of the business (whether it’s a company or you’re self-employed).

- 10 to 50 percent of the vehicle is used for business purposes. So it can be included as a business asset or operated as a private vehicle.

- Less than 10 percent of the vehicle is used for business purposes. Then it cannot qualify as a business asset, it is always classed as a private vehicle.

If a vehicle (regardless of whether it is necessary or “arbitrary”) is now included in the business assets, its costs can be deducted from the tax as business expenses. In return, however, its private use must be taxed as a monetary advantage.

The mileage logbook

The second option for taxing cars used mainly for business purposes is to show the proportion of business and private use of a company car. This is where the mileage log comes in. In this logbook, you record exactly how often and for how long you drive the car for business and private purposes. From this, the duration and frequency of business use and private use can be derived as a monetary advantage. The basis for the calculation is not a (possibly fictitious) new price of the vehicle, but the actual total expenditure.

Keeping a mileage log is, in many cases, more tax-efficient than claiming actual expenses, but requires a certain amount of effort. The law places relatively strict requirements on such a protocol. Accordingly, the mileage log should be “orderly.” The HMRC has determined what this means as follows: A mileage log must be kept promptly (i.e. continuously) and in a closed form, and must show the journeys undertaken in full and continuously, including the mileage reached at the end of each journey. At least the following information must be provided:

- The date and mileage at the beginning and end of each individual trip

- Destination and itinerary (in the event of detours)

- Travel purpose and business partners visited

Care is important

You are required to record the details of both business and private trips in a logbook. You must do this legibly, promptly, completely, and transparently. The date should be exact, i.e. must not be rounded up or down or entered subsequently for several days. If changes are necessary (errors can happen, after all), the change must remain clearly visible.

It is important that you also list the details for frequently repeated trips. Simplified documentation is not sufficient. However, time is an optional entry and does not have to be entered.

The above guidelines must be followed if you want to maintain your logbook properly. In addition, the same must not just be a collection of individual sheets: a closed form is required. This applies to both the paper form (book or booklet) and to electronic mileage logs.

Since Excel files can be modified at will without tracking changes, the tax authorities will not accept them as a logbook. This even applies if you record all the necessary data in tables, print them out, and bind the loose sheets.

Are there exceptions when it comes to recording obligations?

There are exceptions for certain professional groups when it comes to recording obligations. They are not required to provide such detailed journey information. These include:

- Commercial vehicle drivers

- Driving instructors

- Car rental operators

- Taxi drivers

- Courier drivers

The reason for there being reduced requirements is the disproportionately high effort per trip in these instances. It is assumed that the operational reasons for journeys and the scope of private journeys are sufficiently explained and can be checked. Taxi drivers, for example, only have to write the mileage in their driver’s logbook at the beginning and end of their workday. In the case of driving instructors, a reference for the training trip as well as the corresponding mileage at the beginning and end of the journey are sufficient.

Documentation of private trips is less time-consuming

For the documentation of private journeys, the rules are less strict. Simple mileage information is sufficient. A short note in the mileage log is enough for journeys between home and the workplace.

In principle, however, a separate logbook must be kept for each vehicle. The necessary information in the logbook includes the registration number and the mileage at the beginning and end of the year or at the beginning and end of vehicle use. If the vehicle is used by more than one person, the respective driver must also be entered for each trip.

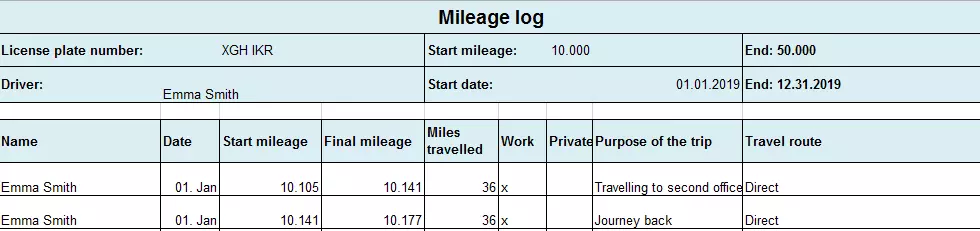

An example of entries in the logbook

The checklist for your mileage logbook

Here you can find a checklist for your logbook:

- A separate mileage log must be kept for each vehicle

- The mileage log must have a closed format

- The official vehicle registration number and mileage at the beginning and end of the year or the period of use must be entered in the logbook

- Each individual journey must be entered with the mileage at the beginning and end, the distance covered, and a reference to the reason for the journey

- If several drivers use the car, then the respective names must also be entered for the individual journeys

- Entries must be clear and legible

- Documentation must be timely and chronological; data must not be entered in bundled form

- The figures must be exact and may not be rounded up

- Subsequent changes are only permitted to a limited extent and must be recognisable

What type of mileage log should you choose?

Have you decided to keep a mileage log? Then you are faced with another decision: Which logging method should you use?

- Mileage log in paper form

- Mileage log in electronic form

A paper logbook is the classic choice. You can purchase one at your local office supply shop, or create one yourself. Online, there are many mileage log templates. It can easily be stowed in the glove compartment so it’s always at hand and can be filled out before the start of the journey and again after arrival. Of course, you can also keep an Excel spreadsheet for your own statistics – however, you cannot present it to the tax authorities as a mileage log.

In our digital times, it is of course also possible to keep an electronic mileage log. Smartphone apps determine the vehicle position using GPS and automatically document the distances covered. If the app records the date, mileage, and destination, the legislator even allows you to add the reason for the trip up to a week later. With the manual mileage log method, on the other hand, you cannot do this. Another advantage is that these apps are relatively inexpensive or even free of charge.

However, it should be remembered that incorrect documentation does not excuse a faulty mileage log. Use the electronic version only if you can use it correctly. Otherwise, there is a risk of problems with the tax office.

Not all apps are recognised by the tax office. It is therefore advisable to check in advance whether the application of your choice meets the legal requirements. The central point is that subsequent changes must be technically impossible or at least remain visible. Be sure to consult with the tax authorities whether or not your mileage log app is permitted. A way to avoid this: Keep a handwritten mileage log alongside the digital one for the first year.

As an alternative to smartphone apps, there are also electronic driver’s mileage logs that are permanently installed in the vehicle or can be plugged into an on-board socket in the car.

Are mileage logs checked?

Mileage logs should be submitted with tax returns, and may be checked at the discretion of the IRS. Entries will then be checked for plausibility, for example, by comparing them to other information provided in your tax return. The place and date of workshop visits and expense reports should match information provided in the mileage log. If the HMRC finds discrepancies, it can reject the mileage log and conduct an audit. A deliberate falsification of the driver’s logbook can also result in a tax evasion fine.

Mileage logs vs. actual expenses

When claiming business vehicle deductions on your tax return, you also have the option of deducting actual vehicle expenses. Actual expenses cannot be claimed if you are using a mileage log already. Deducting actual expenses requires you to keep records and receipts of all costs concerning the vehicle, from general maintenance to repairs. In order to find out which of the two methods is better for you from a taxation point of view, you should conduct a comparison of how many business miles were driven vs. how much money was spent on the vehicle throughout the tax year.

Please note the legal disclaimer relating to this article.