Travel expense accounting: how to correctly reimburse travel expenses

Business trips are the order of the day in many professions. In most cases, the costs incurred are paid by the employer, but not always. If employees have to bear the travel expenses themselves according to the contract, they can claim them back in their tax return. To make sure the process runs smoothly, you have to document everything on a travel expense report.

What is a travel expense report?

A travel expense report is an organised way for businesses and employees to track and report their expenses when they go on business-related trips. The report itself can either be printed out on paper or be digital in the form of a spreadsheet. Employees are also requested to attach any receipts to the form for tax purposes. It is especially important to track any expenses that are tax deductible. In order to stay on top of reimbursable expenses, employees are often given a deadline by which they need to file an expense report and turn in applicable receipts.

How do employers pay for employee travel expenses?

Make sure you’re familiar with your company’s business travel policy so that you know what you will get reimbursed for. Here are some ways that companies pay employee travel expenses.

Company credit cards

These are often given to employees that have to travel often. They can simply pay for everything business-related on this card and for situations that require cash (e.g. tips and snacks), employees can note these down in the travel expense report. By paying directly with the credit card, it saves the employee a lot of trouble since they don’t have to use their own cash before being reimbursed.

Cash

If the company prefers cash, the employee will have to fill out a travel expense report, listing everything they’ve spent their money on. Receipts are required and often justification is needed for each expense. However, big costs such as accommodation or flights are almost always paid for by the employer on the company’s credit card. It would be unfair to expect the employee to fork out so much even if they are getting reimbursed afterwards.

According to a survey of 2,000 UK employees, more than a third of those asked said that they forget to claim expenses from the employer after paying upfront. 58% admitted to not claiming on purpose if the total came to less than five pounds. It was noted that women claimed a lot less than men: £76 compared to £199. It makes sense to claim so you’re not left out of pocket.

Benchmark scale rate payments (BSR)

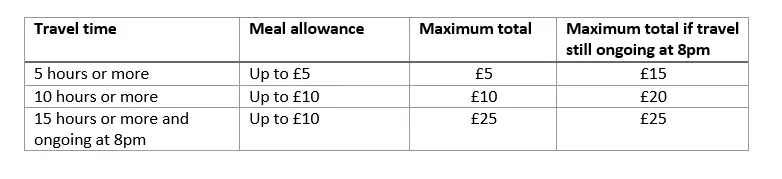

These are a kind of daily “allowance” that the employee is given to pay for their expenses. It’s sometimes referred to as “per diem” in other countries, but HMRC doesn’t use this term. As long as the employee has spent the money for business purposes, the employer doesn’t need to check all the receipts, just a sample. These rates come into force on 6th April 2019:

From the 6th of April 2019 onwards, employers who use these benchmark scale rates when paying or reimbursing expenses that employees have incurred, won’t need to be as thorough when checking for evidence for business expenses. The abolition of receipt checking for benchmark scale rates means there is no longer a requirement for employers to check evidence of the amounts spent. The aim of this new policy is to reduce the burden on employers that use the BSR method.

Which expenses can be claimed back in your tax return and which can’t?

You may be able to claim tax relief on the money you’ve spent on food or for anything else you’ve needed on your overnight stay.

It isn’t possible to claim for travelling to and from work, unless you’re travelling to a temporary place of work.

Here are some of the expenses for which you can claim tax relief:

- Hotel accommodation

- Food and drink

- Public transport

- Parking fees

- Congestion charges and tolls

- Business phone calls

The GOV.UK website has a tool, which enables you to check if you can claim.

Travelling with your own vehicle

Not all business trips are made by train, plane, or taxi: sometimes employees feel more comfortable using their own vehicle to get to different work locations, conferences, or hotels.

How much you can claim depends on whether you’re using a vehicle that you’ve bought or leased yourself, or whether the vehicle is owned or leased by the employer (i.e. a company vehicle).

Using your own vehicle

If you use your own vehicle, you can’t claim tax relief on separate expenses like road tax, MOTs, fuel, etc., but just on the approved mileage rate. In order to work out how much you can claim for each tax year, you need to:

- keep records of the dates and mileage of your work journeys

- add up the mileage for each vehicle type you’ve used for work

- subtract any amount your employer pays you towards your costs (often referred to as a “mileage allowance”.)

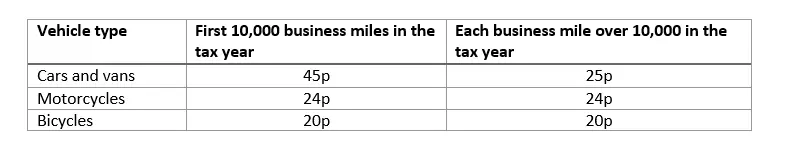

The HMRC-approved Mileage Allowance Payment (MAP) is what the employer pays an employee when they use their own vehicle for business journeys. Here are the rates:

Approved mileage rates

If you receive less than these rates, you will be able to make a claim to HMRC for tax relief on the difference, which will then be used to reduce the amount of tax due on your wages.

Using your company’s vehicle

It’s possible to claim tax relief on the money you’ve spent on fuel and electricity for business trips in the company car. You, however, need to show proof of how much the fuel cost. If your employer reimburses some of the money, you can claim relief on the difference.

International business travel

When an employee goes abroad for work, the employer can decide whether to use individual meal rates or hourly rates, but must stick to whichever they choose. The employer might decide to pay the “24 hour rate”, which starts when the employee arrives at their destination and ends when they leave the country and head back. The other option is for the employer to pay everything separately e.g. the cost of the accommodation and then the cost of the meals.

Separate rules apply if the employee:

- stays at an acquaintance’s place overnight

- receives free meals and accommodation

- stays in an empty residential property or in a place with cooking and laundry facilities.

Spending money

When you spend money abroad, you record it just like you would if you were on a business trip in your country. If you happen to lose your receipts or just want to keep things simple by not even using them, you can take a look at this list of subsistence rates for each country. You can claim the amounts prescribed by HMRC only if you incur expenses up to that amount – these rates aren’t allowances.

Exchange rates can sometimes make things more complicated since they are constantly changing. A $50 meal could cost £37 as you’re eating it, £35 when the amount comes out of your bank account, and £38 when you come to claim it. The best way to combat this is to always use the amount that came out of your bank account.

Leisure time/bringing family

It’s normal to want to spend some time sightseeing on your business trip, especially if you’ve never been to the place before. HMRC has strict rules on leisure time, so if you do too much of it, you might not be able to claim any of your business trip expenses back. If you want to stay a few days longer to soak up the sights, it makes sense to book the outward and return tickets separately so you would claim for the outward ticket, but pay the return out of your own pocket.

If your family has come out to stay with you, make sure to book their travel and hotel separately to yours so their costs aren’t included on the travel expense report.

Please note the legal disclaimer relating to this article.