What is EBITDA and how to calculate?

EBITDA is a financial metric that provides insights into the profitability of various business activities. It is particularly useful for comparing different companies.

What is EBITDA?

EBITDA is an acronym that stands for ‘earnings before interest, tax, depreciation, and amortisation’. As an economic key figure, EBITDA therefore solely represents the result of the company activities, with interest costs and interest earned as well as all depreciation being excluded.

EBITDA plays a crucial role in both a company’s taxation and its evaluation by external organisations. It gives information about the profitability of company activities, and for this reason it is also used to evaluate how creditworthy companies are. Some companies even deploy this key figure to determine manager salaries. The value gives a good impression of the profitability of company activities and leaves out those items that do not have anything to do with it. This includes:

- Interest costs and earnings: Loan interest and earnings from shares are dependent on the financial strategy of a company and do not directly have to do with its activities.

- Taxes: The taxes due depend on many different, often also extraneous factors, and do not say anything about the profitability of company processes.

- Depreciation: Depreciation on tangible assets and immaterial goods is the result of investments that a company wants to or has to make. They are therefore not meaningful when it comes to company processes in the strict sense.

EBITDA is therefore an indication of the status of sales within a company. As depreciation is not included, the key figure does not give any information about the success of a company overall.

In addition to the ‘pure’ EBITDA described above, the term adjusted EBITDA is also commonly used. This metric excludes extraordinary costs and income from the company’s results but retains expenses closely tied to business operations—such as depreciation on assets used for these activities. However, there is no precise definition of what constitutes extraordinary costs and income. As a result, the reliability of this metric when comparing different companies is also limited.

Difference between EBITDA and EBIT

In addition to EBITDA, another key metric that may be of interest to you is EBIT (Earnings Before Interest and Taxes). Unlike EBITDA, EBIT focuses solely on profit before interest and taxes, without factoring in depreciation and amortisation. The term ‘Operating Income’ is often used interchangeably with EBIT.

How to calculate EBITDA

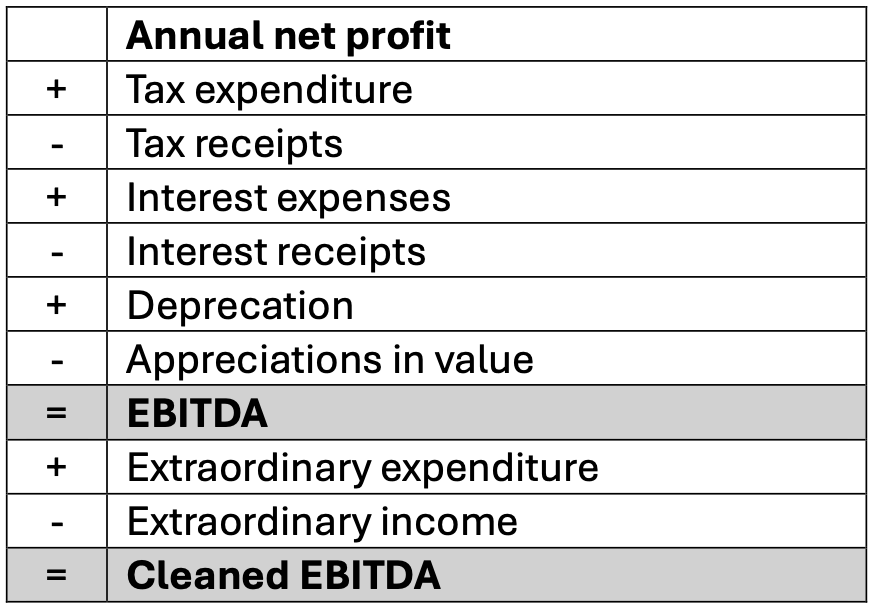

EBITDA is best calculated starting from net income (a value that can be found in the income statement, which is commonly used by businesses and required for publicly traded companies under GAAP. Net income refers to profit after taxes. This means that all items not included in EBITDA are added back or excluded as follows:

UK companies may report financials under UK GAAP (Generally Accepted Accounting Principles), IFRS (International Financial Reporting Standards), or US GAAP (if they are multinational). While EBITDA is not a statutory metric under UK GAAP or IFRS, it is widely used for financial analysis.

You therefore add on expenditure on taxes and interest as well as depreciation, or you deduct the relevant revenues from the result.

The EBITDA margin can ultimately also be calculated from EBITDA. It represents the relationship between EBITDA and sales.

EBITDA explained in two examples

We have chosen two fictitious companies for our example. Each has an annual net profit of £1 million. However, as both companies have their head offices in different countries and also pursue differing financial and investment strategies, there is also a variance between their EBITDA values.

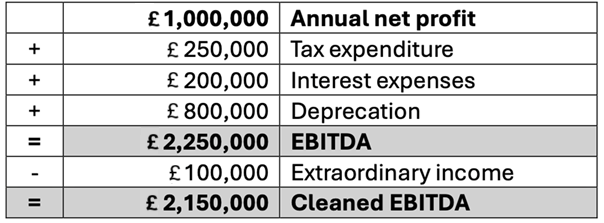

Company 1:

Because there were no earnings in the tax, interest and depreciation items, these factors must be added in full for the EBITDA calculation. Finally, an extraordinary return is deducted for the cleaned EBITDA, which has a positive effect on the annual net profit. The second company has generated the same annual net profit, but is pursuing a completely different financial and investment strategy; it also has its head office in a different country with lower tax on profits.

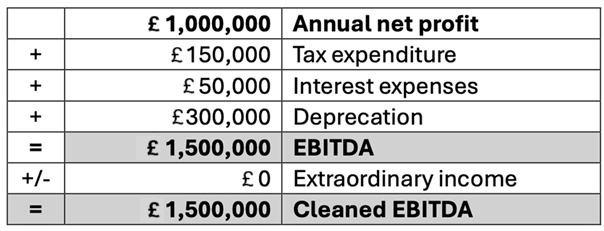

As the second company has to pay less in taxes on the same annual net profit and also records lower costs on interest and depreciation, EBITDA comes out a little lower than for the first company. One would therefore attribute a lower success level in the business operations to the second company. For the second company the ‘adjusted’ EBITDA also corresponds to the uncleaned one, as it did not register either extraordinary revenues or extraordinary expenses in the financial year.

The EBITDA figure gives you the opportunity to assess the result of the operating activities of a company and to compare it with others. However, it does not reflect key factors essential for long-term success.

Please note the legal disclaimer for this article.