Professional invoice templates for Word, Excel and PDF

For an invoice to be recognised by the tax office as an official business document, you must comply with several formal requirements. Invoice templates can assist you in ensuring all necessary details are included.

- Write perfect emails with optional AI features

- Includes domain, spam filter and email forwarding

- Best of all, it's ad-free

What is an invoice template?

Invoice templates are sample invoices that contain all the required components and can be used to map out new invoices. Instead of starting from square one and tediously assembling all of the elements on your own, a template like this provides you with a complete example of an invoice with placeholder information that you just have to exchange for the real data.

Invoice templates can generally be categorised into text-based and tabular formats. For invoices with only a few services, a text-based template is usually the better option. However, as the complexity of billable services increases, a tabular invoice template becomes more useful. This format provides a clearer structure for listing individual prices and the total amount. Additionally, some templates can include built-in functions to automatically calculate values, such as VAT, making invoicing more efficient.

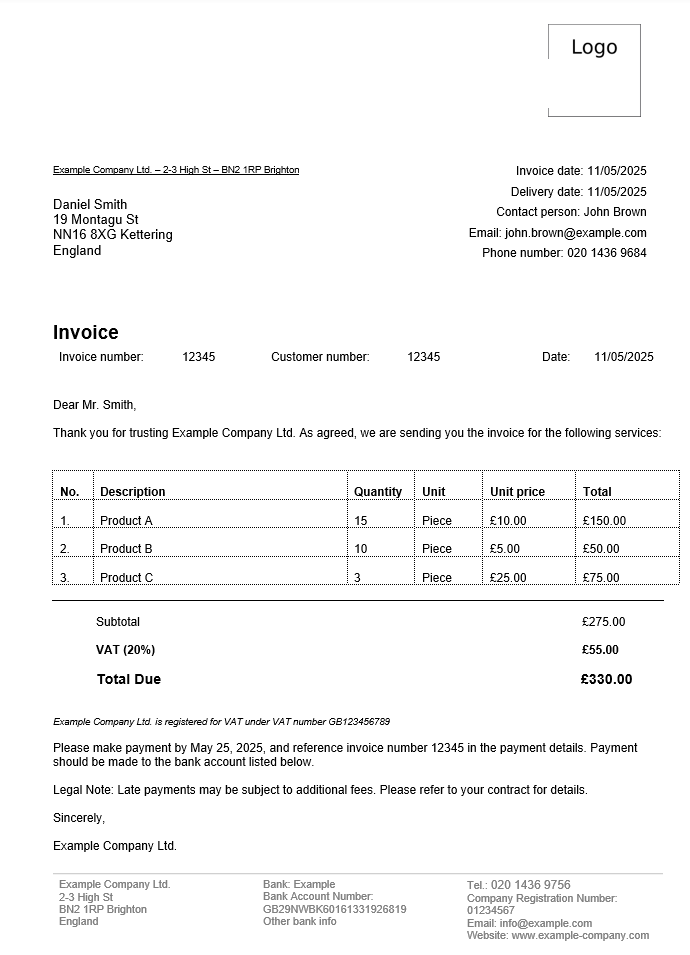

What does a professional invoice template look like?

A professional invoice should be both clear and comprehensive. On one hand, it must be visually appealing and easy to read so that customers can quickly find all relevant details. On the other hand, it must include all necessary information to ensure compliance with tax and record-keeping requirements. Incomplete or inaccurate invoices can cause issues during audits and may even impact tax deductions.

General invoice requirements in the United Kingdom

For a commercial document to be legally recognised as an invoice in the United Kingdom, it must meet the mandatory specifications set by His Majesty’s Revenue and Customs (HMRC):

An invoice must include the following:

- Unique identification number – Each invoice must have a unique, sequential number that uniquely identifies the document.

- Seller’s name, address, and contact details – The name and address of the supplier issuing the invoice.

- Buyer’s name and address – The name and address of the customer being invoiced.

- Invoice date – The date when the invoice is issued.

- Supply date – The date when the goods or services were provided.

- Description of goods or services – A clear description of the items or services provided.

- Unit price and quantity – The price per unit and the total quantity supplied.

- Total amount excluding VAT – The total amount payable before VAT.

- VAT rate and amount (if applicable) – The VAT rate and the corresponding VAT amount.

- Total amount including VAT – The total amount payable, inclusive of VAT.

- Discounts (if any) – If a cash discount is offered, the rate of the discount should be stated.

- Delivery address for legal documents – If using a business name, an address must be provided where legal documents can be delivered.

While not mandatory, additional charges such as shipping, insurance, and handling fees may be included for transparency.

Be sure to check that the listed information is complete and accurate—especially if you are using a template solution for your invoices.

How to use invoice templates for Word and Excel

To help you understand the structure and functionality of the invoice templates for Excel, Word, and other formats, we outline the necessary steps to follow when using them.

Free invoice template download

Your choice simply depends on which program you would rather work with. If you just want to simply and easily achieve the desired goal then a standard-compliant invoice that contains both the complete and correct information about the provided service as well as the appropriate customer data. Open the download for your free invoice template by double-clicking:

How to customise the invoice template step by step

After downloading the free invoice template as a PDF, Excel, or Word file, you only need to customise it to meet your individual requirements. Simply follow our instructions:

- First and foremost, enter your address information or the company address data in the top left corner. Directly underneath, enter the customer’s address information.

- On the right side, you will find another placeholder for your own address information, along with additional contact details such as a phone number or email address. If you do not offer this kind of support, simply remove the corresponding lines from the invoice template.

- Next is the invoice subject, which you can phrase freely. Instead of the simple ‘Invoice’ that’s written in the template, you can, for example, also include the invoice number or any other agreements or conditions.

- Below the subject, you will find three placeholders for the invoice number, the customer number (optional), and the invoice date. Be sure to replace the example numbers here and don’t forget to enter the current date.

- The next line is designated for the header text, where you directly address the customer. Typically, you use this space to thank them for using your services or making a purchase and to provide a brief transition indicating that the following section lists the invoiced costs.

- After addressing the customer, the most important part of the invoice follows: the list of items (products or services). A table is available for this purpose, which you can expand or shorten by adding or removing rows as needed. The columns should include the item description, quantity, unit price, and total price for each item.

- Below the table, you must specify the total amount due before VAT as well as the total invoice amount including VAT.

- At the end of the invoice, there is another text area for additional information, such as notifying the customer of the date the service was provided, or the goods were shipped. It is also common to specify the payment deadline for the amount due.

- The last section of the invoice template is the footer text. Here, you provide your contact details once again, along with the following bank account details, which the customer needs for the payment transfer:

- Company name (to be used on cheques)

- Company address

- Bank account information (if applicable)

- Depending on the nature of your business, you may need to include your VAT Registration Number if your business is VAT-registered. For international sales, VAT rules vary depending on whether you are selling to businesses (B2B) or consumers (B2C). B2B sales to VAT-registered EU companies are typically zero-rated under the reverse charge mechanism, meaning the buyer accounts for VAT, and the customer’s VAT number should be included on the invoice.

- Now you can save and print your invoice template. It’s also possible to save the invoice as a PDF file so that you can send it as an email in the future.

Please note the legal notice for this article.

- Up to 50 GB Exchange email account

- Outlook Web App and collaboration tools

- Expert support & setup service