How to write a receipt of payment (with template)

Using the right receipt template makes filling out a receipt incredibly simple. But what does a receipt template actually include? And why are receipts necessary at all? We’ll guide you through the process of issuing a receipt and highlight the essential details you must include.

What is a receipt of payment?

A receipt of payment is a document that acknowledges payment for a product or service. It typically includes details such as the date and time of purchase, items purchased, total amount paid, payment method, and business details (such as name and location). If the purchase was made in a physical store rather than online, the store’s address is usually included.

In the United Kingdom, there are no legal requirements for businesses to issue receipts for standard transactions, except in certain cases such as VAT invoices for VAT-registered businesses. However, receipts must be accurate and should include key details for tax and record-keeping purposes.

For card payments, businesses must comply with the Payment Card Industry Data Security Standard (PCI DSS), which regulates how card details are stored and displayed. Only the last few digits of a credit/debit card may be shown on a receipt, and expiration dates must not be printed.

What is the purpose of receipts of payment?

Receipts serve several important purposes for both businesses and consumers. They act as proof of payment and provide a record of transactions for financial, legal, and tax-related reasons.

- Proof of purchase – Confirms transactions for returns, warranties, and disputes.

- Legal & tax documentation – Important for business records, VAT reporting (if applicable), and tax deductions for self-employed individuals and businesses.

- Expense tracking – Helps individuals and businesses manage budgets and claim business expenses.

- Fraud prevention – Verifies transactions and helps consumers dispute unauthorised charges.

- Regulatory compliance – Businesses must comply with UK tax laws, including issuing VAT receipts if VAT-registered.

What is the difference between a receipt of payment and an invoice?

An invoice is a request for payment issued by a seller to a buyer. It typically includes:

- Products or services provided

- Prices, VAT (if applicable), discounts, and total amount due

- Payment terms (e.g., due in 30 days or upon receipt)

- Business contact details (e.g., address, phone, website)

Invoices are commonly used in business-to-business (B2B) transactions or for services rendered before payment is received.

A receipt of payment, on the other hand, confirms that payment has been made and that a sale is complete. It serves as:

- Proof of purchase for returns, exchanges, or warranties

- A record of what was bought, how much was paid, and the payment method

- A document that includes business details but usually limited customer information

Receipts are most common in business-to-consumer (B2C) transactions and for immediate payments.

UK businesses are not legally required to issue receipts unless requested by the customer or required for VAT records.

How to fill out a receipt of payment correctly

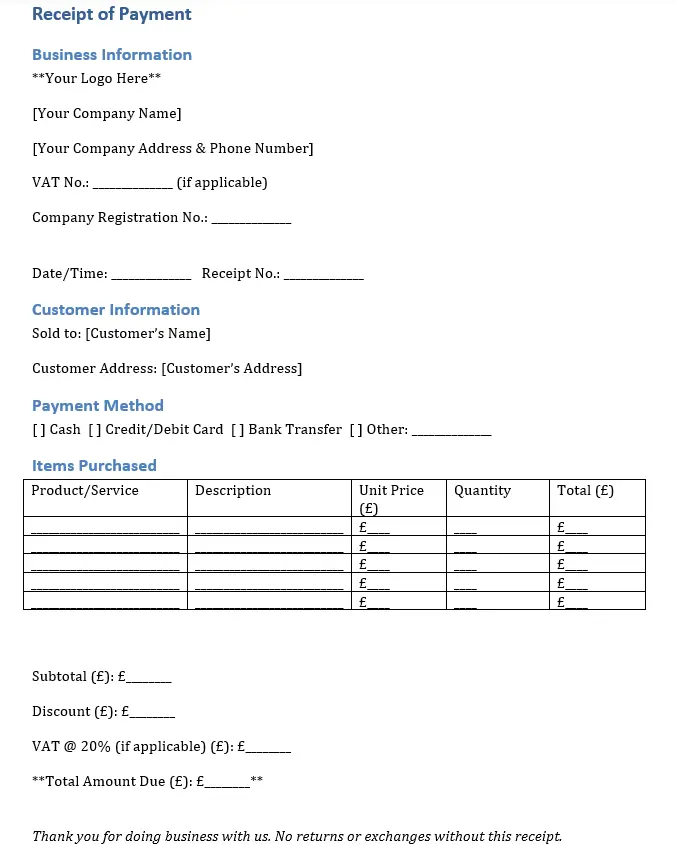

A receipt of payment should typically include the following:

✓ Title: ‘Receipt’ (optional but recommended)

✓ Transaction date and time

✓ Receipt number (for tracking, but not legally required)

✓ Business name and address

✓ Items purchased or services provided (with description and quantity)

✓ Price per item and total amount paid

✓ VAT amount and VAT rate (if applicable, for VAT-registered businesses)

✓ Total including VAT (if applicable)

✓ Payment method (cash, card, etc.)

✓ Merchant contact information (phone, email, or website)

Extra points to consider for compliance

- VAT considerations: If a business is VAT-registered, the receipt should include a VAT breakdown. If the transaction is zero-rated or VAT-exempt, this should be stated.

- Legal requirements: A receipt is not legally required unless a VAT invoice is needed, but businesses commonly issue receipts as proof of purchase.

- Card payment security: Businesses must comply with PCI DSS (Payment Card Industry Data Security Standard) rules—receipts should only show the last 4 digits of a card number and never include the expiration date.

- Keep records: Businesses must retain receipts for six years as part of their financial records.

You can issue a receipt of payment either electronically or on paper. It can be created by hand using a receipt book or generated using a digital receipt template on your computer. However, HMRC requires that records be kept digitally for VAT-registered businesses under Making Tax Digital (MTD).

Using accounting software can streamline this process by integrating receipt creation with your overall bookkeeping. This helps to automate data entry, saving time and reducing errors. If your business issues a high volume of receipts, switching to a digital solution may be more efficient.

If you don’t have accounting software or prefer physical copies, you can use a receipt book, which usually includes duplicate pages (one for the customer and one for your records). Alternatively, pre-made receipt templates can be downloaded and printed for manual use.

Receipt template to download

This is an example of how a receipt of payment looks:

Please note the legal disclaimer for this article.