How to create a private invoice using a template

As a private individual, writing an invoice may become necessary in many situations—whether after selling a used item or for a one-time service. In this article, you will learn step by step how to create a proper private invoice and what to consider. We’ve also included a practical Word template for download.

What is a private invoice?

In the UK, private individuals can issue invoices in certain situations. If you sell a used personal item, provide a non-professional service, or conduct a financial transaction where the buyer requests a receipt, you may need to create a private invoice. Businesses may also request invoices when purchasing goods or services from private individuals.

However, it is important to understand when issuing an invoice might have tax or legal consequences. HM Revenue & Customs (HMRC) may classify your transactions as business activity rather than private sales if:

- You regularly sell items for profit.

- You buy items with the intention of reselling them.

- You make goods to sell.

- You provide services in a self-employed capacity.

If your sales are deemed a business, you may need to register as self-employed and report your income for tax purposes.

What are the tax regulations for private invoices?

Private individuals can issue invoices, but tax obligations depend on the nature and frequency of transactions.

Occasional private sales (non-taxable)

- Selling used personal items for less than their original purchase price is not subject to tax.

- There is no requirement to charge VAT or report income if selling infrequently and not for profit.

- Examples: Selling a second-hand phone, used clothes, or old furniture.

Selling for profit (taxable)

- If you sell an item for more than you originally paid, you may be liable for Capital Gains Tax (CGT). This typically applies to valuable assets like antiques, art, or property.

- There is a Capital Gains Tax allowance (£6,000 for 2023/24), meaning CGT is only payable if your total gains exceed this threshold.

Frequent sales = business

If you regularly sell goods or services for profit, HM Revenue & Customs (HMRC) may classify you as a business, requiring:

- Self-assessment tax return filing (declaring income and expenses).

- Income tax payment on profits.

- VAT registration if your total sales exceed £90,000 per year (2024 threshold).

Income reporting for services

- If you provide services as a private individual (e.g., tutoring, freelancing), you must report income if it exceeds £1,000 per tax year (HMRC’s trading allowance).

- If your earnings exceed this amount, you may need to register as self-employed and file a Self-Assessment tax return.

Online selling & HMRC reporting

- Online platforms like eBay, Etsy, PayPal, and Vinted may report high-value transactions to HMRC.

- If you regularly sell items online for profit, you may be considered a trader, requiring tax registration.

When should you, as a private person, issue an invoice?

If you are providing goods or services as a private individual, you can issue an invoice to another private person or even a business. There are no strict legal requirements for private invoices, but they can serve as proof of payment and clarify the terms of a transaction.

- Write perfect emails with optional AI features

- Includes domain, spam filter and email forwarding

- Best of all, it's ad-free

What should a private invoice include?

While there are no formal rules, a well-structured invoice should contain the following:

- Your name and address (issuer)

- Buyer’s name and address (recipient)

- Invoice date and location

- Reason for the invoice (e.g., sale of goods, service rendered)

- Detailed list of goods/services provided, including date of delivery/service and quantity, description, unit price, and total price

- Total amount due

- Payment terms (e.g., ‘Due immediately’ or ‘Payable within 10 days’)

- Payment method and details (if necessary, include bank details or preferred payment method)

A polite closing, such as a greeting or a thank-you note, can add a professional touch.

If payment is not made in cash, it is advisable to keep a copy of the invoice for your records, especially for tax purposes.

Other details of the legal transaction can also be included on the private invoice. If, for example, a used item being sold has a known defect, it is worth noting that on the private invoice.

‘As previously discussed, the phone’s display screen has a few small scratches on the top left’.

What should NOT be included on a private invoice?

- VAT (Value-Added Tax) – Private individuals do not charge VAT unless they are VAT-registered businesses (threshold: £90,000/year as of 2024).

- Business details: Do not include a business name, tax ID, or VAT number unless you are officially registered as a business.

To avoid misunderstandings, you may want to include a note such as: ‘This invoice is for a private transaction and does not include sales tax’.

When does a private sale become a business?

Occasional private sales are not taxable in the UK, but if you regularly sell goods or services for profit, HM Revenue & Customs (HMRC) may classify you as a business, requiring you to register for tax purposes.

If you frequently sell items, buy goods with the intent to resell, make products to sell, or provide paid services such as tutoring or graphic design, HMRC may consider you a trader. Actively marketing your products or maintaining an online store on platforms like eBay, Etsy, or Facebook Marketplace can also indicate business activity.

If your total earnings from sales or services exceed £1,000 per year, you must register as self-employed with HMRC and report your income. If your total self-employment earnings exceed £12,570 per year, you must file a Self-Assessment tax return and pay Income Tax and National Insurance. If your annual sales are more than £90,000, you must register for VAT and charge VAT on taxable goods or services.

Occasional private sales, such as selling second-hand personal items for less than their original price, are not classified as business activity and do not need to be reported. However, if you regularly sell for profit, you may need to register and comply with tax obligations.

Capital Gains Tax (CGT) applies if an item is sold for more than £6,000, except for cars and personal belongings.

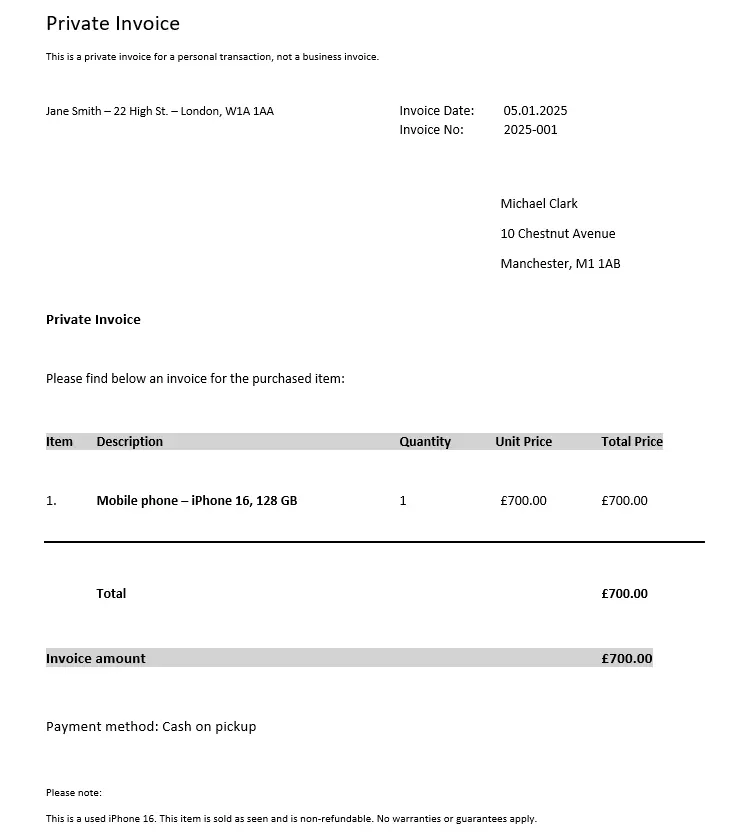

Private invoice template to download

Whether using a text editor or invoicing software, issuing an invoice as a private individual is quick and easy. Make sure to include all essential details and add any necessary notes, such as a description of the invoiced item, at the end of the document. Keep a copy of the invoice—either digitally or on paper—for future reference, for example, when filing your tax return.

Please note the legal disclaimer for this article.